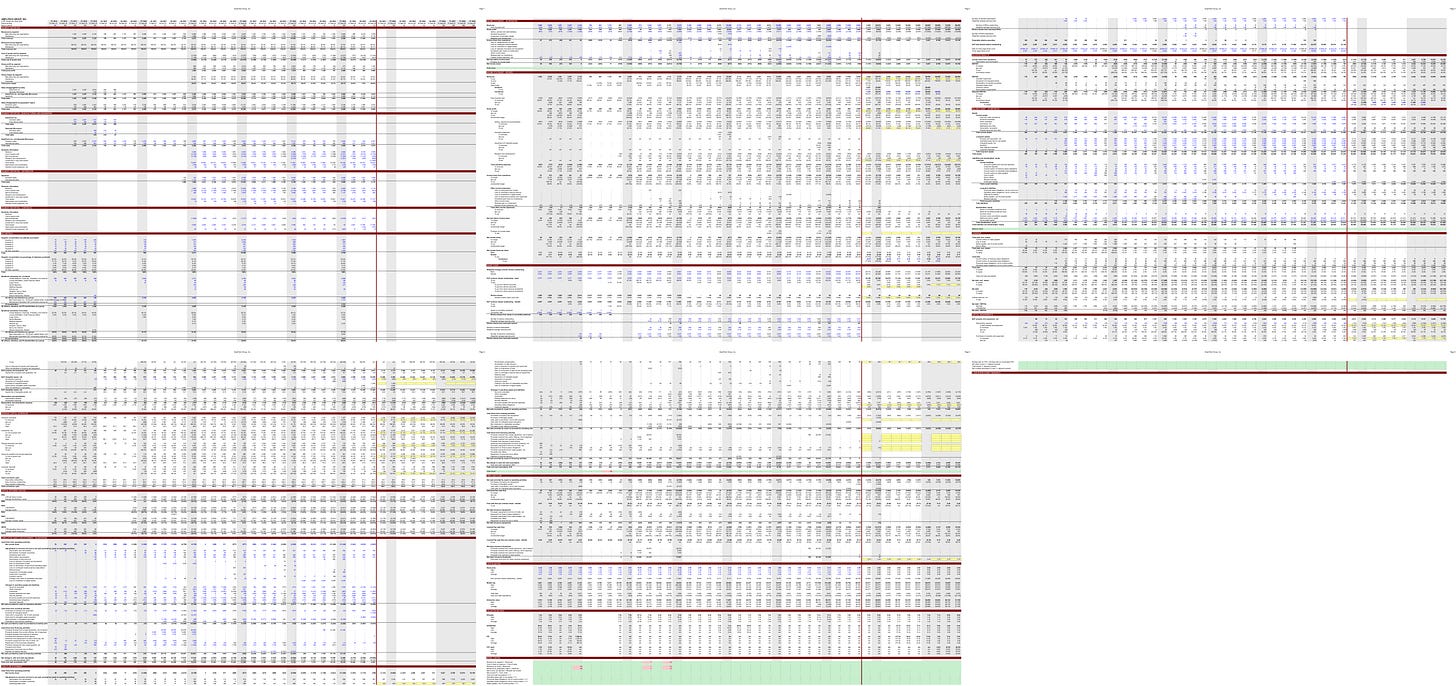

AmpliTech Group, Inc. (AMPG)

New Watchlist Model Updated for Q3 2025 | New Build

AmpliTech Group, Inc. (AMPG)

AMPG is a designer and manufacturer of advanced radio-frequency and microwave signal-processing components and systems for satcom, 5G telecom, defense, and quantum computing applications. After years of modest revenues, heavy R&D spend, and consistent dilution, the company has consolidated around two core product lines, 5G ORAN radios and signal amplifiers, entering a rapid growth phase as the only U.S.-based, vertically integrated supplier of low-noise amplifier technology and 5G infrastructure components.

Early commercialization traction and validated market demand have already translated into triple-digit growth, allowing the company to raise FY25 guidance twice to a record $25M, nearly triple FY24 sales. This operational inflection was primarily driven by two recently secured LOIs, totaling $118M, with Tier 1 ORAN 5G telecom customers, including Telus, for the delivery of its new radio solutions. Fulfillment of these LOIs alone implies a 25-30% annual growth trajectory through 2030, incremental to new MNO wins or expanded business from existing customers.

While not binding, these LOIs follow months of technical proof-of-concept meetings and include predetermined minimum quantities and delivery schedules, with shipments expected to ramp materially through 2027. Assuming continuation of the current order pace and based on customer-provided forecasts and delivery visibility, FY26 revenue is expected to double from the FY25 guide to at least $50M, with follow-on orders from its existing blue-chip customer base and new customers further expanding its backlog.

Beyond the secular ORAN 5G upgrade cycle, AMPG’s cryogenic LNAs provide early-stage exposure to the emerging quantum computing market, while its RF expertise extends into emerging defense and aerospace applications, including advanced drones. With zero long-term debt, a scalable cost structure, and high insider ownership, the company is set for successive quarters of growth and sustained double-digit gross margins, providing a clear path to profitability in FY26 as production costs normalize, one-time costs are reduced, and higher margin follow-on business ramps.