Catalyst Watch #10

45 Actionable Event-Driven Setups

Yesterday, Byron Street Research was featured on Substack’s Rising in Finance leaderboard. I wanted to take a moment to thank each one of you for making this possible within just a year of launch.

Next week, premium subscribers will gain access to an interactive database of past Catalyst Watch entries, updated weekly after each issue. You may also have the option to duplicate the template to manually flag tickers for further review.

Last Thursday, I profiled Hydreight Technologies Inc. (TSXV:NURS; OTCQB:HYDTF). The setup is binary: either execution lifts the stock to multiples of its current price, or guidance proves too optimistic. Given VSDHOne’s rapid early adoption, the odds are heavily tilted toward the former. Take a look if you haven’t already!

Scroll down to continue reading this week’s most actionable corporate events, along with quick pitches on previously flagged setups, available in HTML format. For all past setups and pitches, please refer to the PDF file at the end.

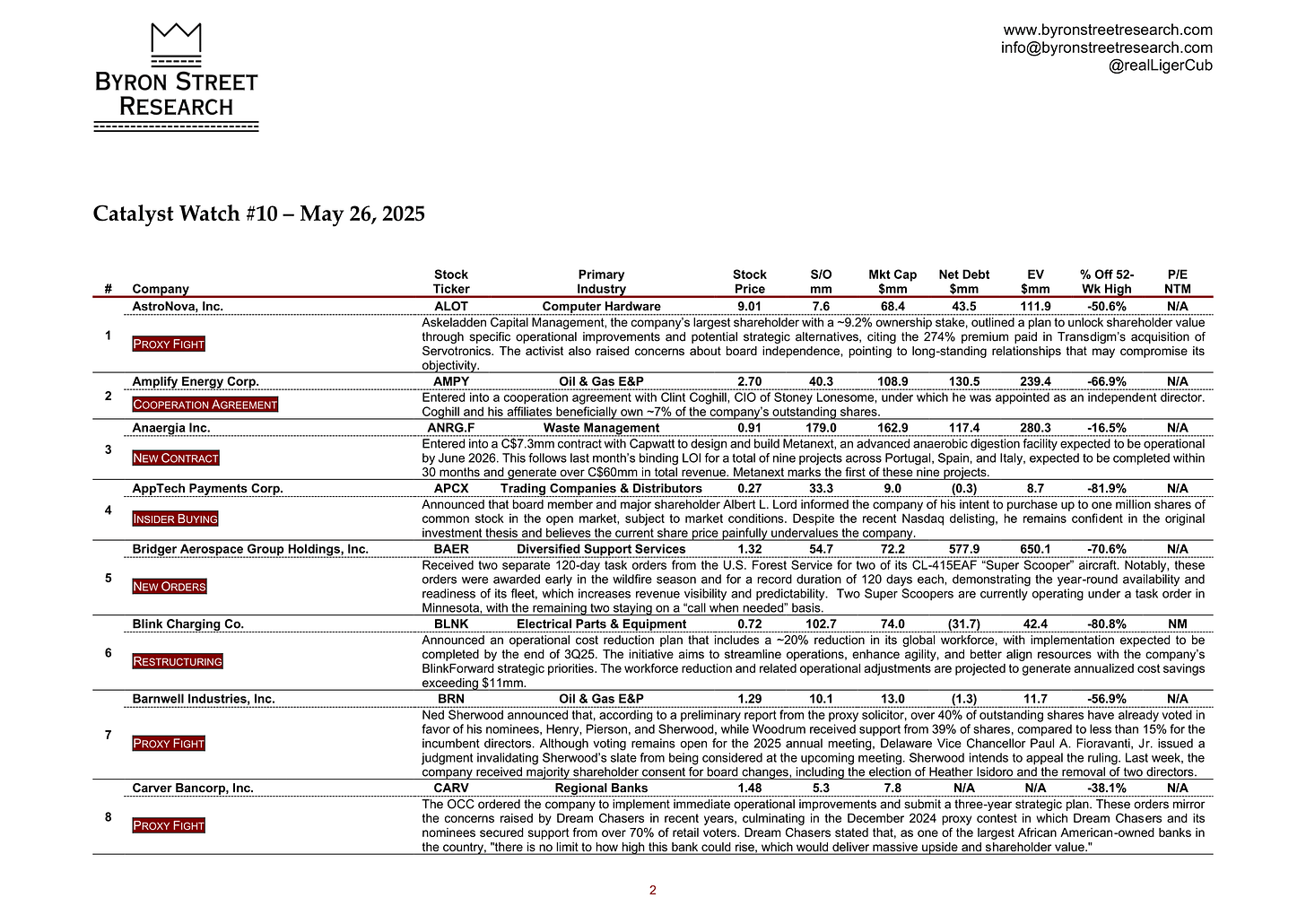

This Week’s Most Actionable Corporate Events

AstroNova, Inc. (ALOT) | Computer Hardware | $9.01 | $68.4mm

Proxy Fight: Askeladden Capital Management, the company’s largest shareholder with a ~9.2% ownership stake, outlined a plan to unlock shareholder value through specific operational improvements and potential strategic alternatives, citing the 274% premium paid in Transdigm’s acquisition of Servotronics. The activist also raised concerns about board independence, pointing to long-standing relationships that may compromise its objectivity.

Amplify Energy Corp. (AMPY) | Oil & Gas E&P | $2.70 | $108.9mm

Cooperation Agreement: Entered into a cooperation agreement with Clint Coghill, CIO of Stoney Lonesome, under which he was appointed as an independent director. Coghill and his affiliates beneficially own ~7% of the company’s outstanding shares.

Anaergia Inc. (ANRG.F) | Waste Management | $0.91 | $162.9mm

New Contract: Entered into a C$7.3mm contract with Capwatt to design and build Metanext, an advanced anaerobic digestion facility expected to be operational by June 2026. This follows last month’s binding LOI for a total of nine projects across Portugal, Spain, and Italy, expected to be completed within 30 months and generate over C$60mm in total revenue. Metanext marks the first of these nine projects.

AppTech Payments Corp. (APCX) | Trading Companies & Distributors | $0.27 | $9.0mm

Insider Buying: Announced that board member and major shareholder Albert L. Lord informed the company of his intent to purchase up to one million shares of common stock in the open market, subject to market conditions. Despite the recent Nasdaq delisting, he remains confident in the original investment thesis and believes the current share price painfully undervalues the company.

Bridger Aerospace Group Holdings, Inc. (BAER) | Diversified Support Services | $1.32 | $72.2mm

New Orders: Received two separate 120-day task orders from the U.S. Forest Service for two of its CL-415EAF “Super Scooper” aircraft. Notably, these orders were awarded early in the wildfire season and for a record duration of 120 days each, demonstrating the year-round availability and readiness of its fleet, which increases revenue visibility and predictability. Two Super Scoopers are currently operating under a task order in Minnesota, with the remaining two staying on a “call when needed” basis.

Blink Charging Co. (BLNK) | Electrical Parts & Equipment | $0.72 | $74.0mm

Restructuring: Announced an operational cost reduction plan that includes a ~20% reduction in its global workforce, with implementation expected to be completed by the end of 3Q25. The initiative aims to streamline operations, enhance agility, and better align resources with the company’s BlinkForward strategic priorities. The workforce reduction and related operational adjustments are projected to generate annualized cost savings exceeding $11mm.

Barnwell Industries, Inc. (BRN) | Oil & Gas E&P | $1.29 | $13.0mm

Proxy Fight: Ned Sherwood announced that, according to a preliminary report from the proxy solicitor, over 40% of outstanding shares have already voted in favor of his nominees, Henry, Pierson, and Sherwood, while Woodrum received support from 39% of shares, compared to less than 15% for the incumbent directors. Although voting remains open for the 2025 annual meeting, Delaware Vice Chancellor Paul A. Fioravanti, Jr. issued a judgment invalidating Sherwood’s slate from being considered at the upcoming meeting. Sherwood intends to appeal the ruling. Last week, the company received majority shareholder consent for board changes, including the election of Heather Isidoro and the removal of two directors.

Carver Bancorp, Inc. (CARV) | Regional Banks | $1.48 | $7.8mm

Proxy Fight: The OCC ordered the company to implement immediate operational improvements and submit a three-year strategic plan. These orders mirror the concerns raised by Dream Chasers in recent years, culminating in the December 2024 proxy contest in which Dream Chasers and its nominees secured support from over 70% of retail voters. Dream Chasers stated that, as one of the largest African American-owned banks in the country, "there is no limit to how high this bank could rise, which would deliver massive upside and shareholder value."

Traeger, Inc. (COOK) | Household Appliances | $1.30 | $176.4mm

Restructuring: Approved a multi-step strategic optimization plan to streamline its organizational structure and reduce headcount to boost profitability, with significant changes expected by year-end. Earlier this month, the company raised prices and slowed hiring, among other measures, to offset the impact of Trump’s tariff plans and protect its balance sheet.

Civeo Corporation (CVEO) | Diversified Support Services | $20.88 | $280.9mm

New Contract: Awarded a three-year contract with a leading metallurgical coal producer to provide integrated services at two villages in the Australian Bowen Basin, expected to commence next month. This marks the company’s first integrated services contract awarded in Queensland. The producer, one of the company’s largest customers at Civeo-owned villages for over a decade, is anticipated to generate ~A$64mm in revenues over the 2025-2028 contract period. This contract was included in the company’s latest FY25 revenue and adj. EBITDA guidance.

Donnelley Financial Solutions, Inc. (DFIN) | Financial Exchanges & Data | $53.83 | $1,487.8mm

Stock Buyback: Authorized a new $150mm share repurchase program, effective through the end of 2026. This program replaces the prior $150mm authorization, which had ~$15mm remaining.

Datavault AI Inc. (DVLT) | Semiconductors | $0.88 | $56.4mm

Asset Purchases: Completed the purchase of technology assets from CompuSystems, Inc. (CSI), providing growth opportunities for both the acoustic and data divisions. Having already begun client outreach since the deal’s announcement, the company expects CSI to generate solid revenue in 2025, contributing the majority of its 2H25 revenue target of $12mm to $15mm. Building on this momentum, the acquisition is projected to drive $15mm to $20mm of the company’s $40mm to $50mm total revenue target in 2026, supported by DVHOLO, Adio, WiSA, and Data Vault licensing and sales related to its patented Information Data Exchange.

Educational Development Corporation (EDUC) | Distributors | $1.35 | $11.6mm

Asset Sale: Executed a Purchase and Sale Agreement with TG OTC for its Hilti Complex headquarters and distribution warehouse located in Tulsa, Oklahoma, for $35.15mm, less seller fees and closing costs. Proceeds from the sale will be used to fully repay the outstanding Term Loans and Revolving Loan, leaving the company debt-free, with management expecting limited borrowing needs going forward. The sale is expected to close within 30 days following the 90-day due diligence period.

Forward Industries, Inc. (FORD) | Footwear & Accessories | $7.51 | $8.3mm

Asset Sales: Entered into a Transaction Agreement with Forward Industries (Asia-Pacific), owned by then-Chairman and CEO Terence Wise. Under the agreement, it sold its wholly owned subsidiary, Forward Industries (Switzerland), and other assets tied to its discontinued OEM business to settle $4.1mm in outstanding payables owed to the buyer.

Foresight Autonomous Holdings Ltd. (FRSX) | Automotive Parts & Equipment | $0.58 | $12.5mm

New Agreement: Signed a development and commercialization agreement with StreamRail, a global Chinese rail technology company, to integrate and commercialize its products for StreamRail’s customers, focusing on urban trams and metro trains. Upon successful completion of development, both parties will proceed with manufacturing, marketing, and distributing the product to StreamRail’s customers and third parties. The project’s revenue potential is estimated at up to $12mm by 2029, with initial commercialization expected in 2026. Under the agreement, StreamRail has secured exclusive distribution rights in China, contingent on achieving sales of at least $1.5mm during 2026 and 2027.

Green Impact Partners Inc. (GIPI.F) | Waste Management | $2.33 | $57.0mm

Asset Sales: Entered into a definitive agreement with a private, arm’s-length party for the sale of its water, waste treatment, and recycling facilities located in Alberta and Saskatchewan for proceeds of $53.25mm, subject to working capital adjustments, with closing expected on or before June 30. Proceeds from the transaction will be used to fully repay the company’s revolving credit facility, under which the company remains in default. Additionally, the company has finalized a non-binding equity term sheet with a global Japanese investment partner for lead project equity investment in Future Energy Park, expected to become one of North America’s largest carbon-negative biofuels facilities at an estimated cost of ~$2.0bn, including ~$500mm in soft costs.

Generation Income Properties, Inc. (GIPR) | Diversified REITs | $1.61 | $8.8mm

Strategic Alternatives: Initiated a review of strategic alternatives to identify opportunities to maximize shareholder value, following inbound expressions of interest. The Board will consider a broad range of options, including but not limited to a sale, merger, or other strategic or financial transactions.

Genasys Inc. (GNSS) | Communications Equipment | $1.66 | $75.0mm

Business Update: Received a partial deposit for the third of seven dam groups last Friday, with the remainder expected within the next few weeks. The first three of the seven dam groups have been designed and approved by the Puerto Rico Electric Power Authority (PREPA) as part of the previously announced $75mm contract to provide PREPA with an Emergency Warning System (EWS) to protect residents and visitors downstream of the island’s 37 dams. The total value of these first three groups exceeds $36mm, with deposits of 60% of each group’s value paid upon design approval. The company received two such deposits in Q1. Current shipping schedules call for delivery of all materials required to complete all three groups by Q4.

Lazydays Holdings, Inc. (GORV) | Automotive Retail | $0.29 | $31.7mm

Asset Sales: Entered into an Asset Purchase Agreement with Fun Town RV to sell substantially all assets tied to its Las Vegas RV dealership operations for ~$300k, plus additional cash consideration for new and used RV inventory. The agreement also includes the sale of dealership real estate and a leasehold interest in Surprise, Arizona, for ~$6.7mm in cash. A portion of the proceeds will be used to repay the company's outstanding debt.

HOOKIPA Pharma Inc. (HOOK) | Biotechnology | $1.51 | $18.9mm

Asset Sales: Entered into an Asset Purchase Agreement with Gilead Sciences to sell assets related to its HB-400 and HB-500 programs, originating from a 2022 agreement between the two companies, for up to $10mm. In February, the company terminated its planned merger with Poolbeg Pharma, following a challenging 2024 that included layoffs after Roche ended its collaboration on the HB-700 program targeting KRAS-mutated cancers. Following the transaction, the company will wind down operations and initiate steps to dissolve.

Hudson Global, Inc. (HSON) | Staffing & Employment Services | $9.00 | $24.8mm

Merger Agreement: Signed a definitive merger agreement with Star Equity Holdings, under which Star will merge into a wholly owned subsidiary of the company in an all-stock transaction at an exchange ratio of 0.23 shares. The merger will create a larger, multi-sector holding company, with pro forma annualized revenues of $210mm, "on better path to eventually getting added to the Russell 2000 index." The newly formed subsidiary is targeting $40mm in adj. EBITDA by 2030, with at least $2mm in projected annualized cost savings within 12 months post-close, equating to ~$0.57 in incremental pro forma EPS.

Fusion Fuel Green PLC (HTOO) | Electrical Parts & Equipment | $0.31 | $7.5mm

New Contracts: Secured ~$2.7mm in new engineering contracts since March 2025. Since January 2025, the company has added over 1,800 residential service contracts and two commercial service contracts to its portfolio, generating an estimated recurring revenue of more than $0.9mm. As a result, current billings for utility solutions now cover over 12,000 customers and 170 food and beverage outlets. The company continues to expand operations in the UAE due to increased migration and growth in the construction sector.

Hyliion Holdings Corp. (HYLN) | Auto Parts | $1.20 | $210.3mm

New Agreement: Signed a strategic memorandum of understanding during the Saudi-U.S. Investment Forum 2025 in Riyadh, establishing a collaborative effort to validate, adapt, scale, and assemble KARNO Power Modules for the Saudi Arabian market, outlining a potential $1bn business opportunity. Building on a previously signed letter of intent, the company and Alkhorayef Industries Company will jointly conduct comprehensive validation of two KARNO Power Modules in Saudi Arabia in 2026 and explore regional partnerships to scale assembly and deployment across the Kingdom, among other initiatives. The investment forum was held in conjunction with Trump's state visit, during which $600bn in investment agreements were signed, reinforcing the growing economic ties between the U.S. and Saudi Arabia.

Intellicheck, Inc. (IDN) | Application Software | $4.59 | $91.1mm

New Contract: Signed a new high-value three-year agreement with a top financial customer, expanding the initial digital use cases to include teller workstation transactions. This client now uses the company’s technology in more than 1,900 branches nationwide. The total contract value, in the very high seven-figure range, is expected to make this client one of the company’s top three revenue generators starting in 3Q25.

iQSTEL Inc. (IQST) | Integrated Telecom Services | $9.68 | $25.5mm

Business Update: Issued a follow-up shareholder letter and updated investor deck highlighting its transformation into a high-tech global enterprise with strong fundamentals and a clear path to $1bn in annual revenue by 2027, following its recent Nasdaq uplisting. The company forecasts $340mm in revenue for 2025 and is targeting a $400mm year-end run rate, with high-tech services, such as fintech, AI, and cybersecurity, expected to contribute 20% of the mix, underscoring the scalability of its model.

LeddarTech Holdings Inc. (LDTC) | Application Software | $0.33 | $12.3mm

Restructuring: Announced temporary layoffs of ~138 employees across all locations and departments, representing ~95% of its total workforce, as part of efforts to preserve cash and extend time for discussions with lenders. Additionally, the company is actively evaluating potential alternatives, including restructuring obligations, a sale of the business or certain assets, strategic investments, and other options.

Lifeward Ltd. (LFWD) | Health Care Equipment | $1.26 | $13.9mm

Management Change: Appointed Mark Grant as President and CEO, with outgoing CEO Larry Jasinski set to serve as Co-CEO through the end of 2025 to ensure a smooth transition. Mark brings 30 years of experience in commercial leadership, channel development and strategic solutions, having led teams across multiple geographies. He began his career at Bristol Myers Squibb and FLA Orthopedics before joining Medtronic in 2004, where he rose to Vice President for the Americas by 2023. Most recently, he served as President of the Americas and Chief Commercial Officer at IMRA Surgical, a global leader in ethical surgical training solutions.

Comstock Inc. (LODE) | Other Precious Metals & Mining | $3.05 | $87.3mm

Spinoff: Completed the successful separation of its renewable fuels segment into Bioleum, a newly formed independent entity. This fulfills the first phase of the company’s previously outlined plans and positions it as the parent of two high-growth businesses: one focused on renewable metals and mining in Nevada, and the other on renewable fuels headquartered in Oklahoma.

Lake Shore Bancorp, Inc. (LSBK) | Regional Banks | $15.40 | $87.3mm

Demutualization: Commenced its common stock offering in connection with the proposed conversion of Lake Shore, MHC from a mutual to a stock holding company. As part of the transaction, the bank will convert to a New York commercial bank and be renamed Lake Shore Bank, offering up to 5,750,000 shares at $10.00 each, with a minimum of 4,250,000 shares required to complete the offering. Shares will be offered to eligible depositors and the bank’s employee stock ownership plan.

Movano Inc. (MOVE) | Medical Devices | $0.56 | $3.9mm

Strategic Alternatives: Initiated a process to explore strategic alternatives, including a sale, merger or similar transaction involving the company, to maximize shareholder value. The Company also reported that due to resource constraints, it does not plan to timely file its 1Q25 report.

Oramed Pharmaceuticals Inc. (ORMP) | Pharmaceuticals | $2.12 | $86.6mm

Stock Buyback: Announced a one-year extension of its $20mm stock buyback program, originally set to expire in June 2025. The company has already repurchased $2.49mm worth of shares and is retaining the same maximum repurchase value.

Pitney Bowes Inc. (PBI) | Electronic Parts & Instruments | $10.02 | $1,816.2mm

Management Change: Appointed sitting director and turnaround architect Kurt Wolf as CEO, succeeding Lance Rosenzweig, who is retiring from his CEO and director roles to serve as a consultant to the company. Since Wolf joined the Board, total shareholder returns have exceeded 200%. The company also announced plans to repurchase $150mm in shares in 2025 and will continue evaluating potential dividend increases. It now expects to reach its 3.0x adj. leverage ratio target by the end of Q2, one quarter ahead of schedule and without further debt retirement. Management will conduct a comprehensive strategic review throughout the remainder of 2025 and reaffirmed all aspects of its previously issued 2025 financial guidance.

Proto Labs, Inc. (PRLB) | Metal Fabrication | $36.82 | $875.2mm

Management Change: Appointed Suresh Krishna as President and CEO, succeeding Rob Bodor, who has entered into a consulting arrangement with the company to ensure a seamless transition. Krishna most recently served as President and CEO of Northern Tool + Equipment, a manufacturer and retailer of tools and commercial equipment, where he accelerated growth through operational and supply chain optimizations. He brings a 30-year track record of overseeing profitable growth and shareholder value creation at manufacturing companies. Concurrently, the company reaffirmed its previously provided 2Q25 outlook, expecting revenue between $124.0mm and $132.0mm and adj. diluted EPS between $0.30 and $0.38.

Quipt Home Medical Corp. (QIPT) | Health Care Services | $1.81 | $78.3mm

Acquisition Proposal: Received an unsolicited, non-binding, conditional, and indicative proposal from Forager Capital Management to acquire 100% of the company’s issued and outstanding common shares at $3.10 per share. The company’s policy is not to comment on unsolicited offers and is confirming receipt solely because Forager made the proposal public. The company had previously entered into a Non-Disclosure and Standstill Agreement with Forager. However, the Board did not grant Forager prior written approval to waive confidentiality or Standstill provisions related to the issuance of this non-binding proposal.

Retractable Technologies, Inc. (RVP) | Health Care Supplies | $0.65 | $19.4mm

New Agreement: Entered into a Settlement Agreement resolving all claims and causes of action with Locke Lord and others. The company will receive $1.9mm, dismiss all claims against the defendants with prejudice, and exchange mutual releases.

Silvercrest Asset Management Group Inc. (SAMG) | Asset Management | $14.06 | $130.2mm

Stock Buyback: Authorized a new $25mm common stock repurchase program. The company had recently exhausted its prior $12mm authorization through block trades, noting a volume uptick during the process.

SuperCom Ltd. (SPCB) | Interactive Media & Services | $8.69 | $35.6mm

New Contract: Secured a new electronic monitoring (EM) contract with an established Virginia-based service provider to immediately deploy its PureSecurity Electronic Monitoring technology, successfully displacing another incumbent vendor. This marks the company’s entry into Virginia, its ninth new U.S. state since mid-2024, further expanding its national footprint and reinforcing rapid growth across North America. Under the agreement, SuperCom will serve as the provider’s primary technology partner in Virginia, supporting both current operations and future statewide expansion, with potential for continued growth through new business opportunities.

TAT Technologies Ltd. (TATT) | Aerospace & Defense | $30.33 | $331.8mm

New Contracts: Signed a five-year MRO agreement with one of the world’s leading cargo carriers, extending an existing contract for APU repairs on the U.S. fleet of 767 and 757 aircraft to now cover the carrier’s global fleet. Additionally, under this agreement, the company will provide repair services for two new APU platforms, B737 and A300, and has been awarded the 777 APU contract for the next seven years. The total value of the contracts, including the awarded but not yet signed 777 APU agreement, is estimated at $40-55mm over the next five years.

TrueBlue, Inc. (TBI) | Staffing & Employment Services | $5.74 | $155.5mm

Acquisition Proposal: HireQuest responded to the company’s rejection of its acquisition offer, arguing that the Board not only continues to refuse engagement but has also taken steps to deter shareholders from weighing in. HireQuest maintains its belief in the compelling strategic and financial merits of its proposal, offering shareholders both an immediate step up in value at closing and the opportunity to participate in the upside of the combined company. Convinced of the enormous potential upside from a strategic combination, HireQuest felt compelled to take this directly to the company’s shareholders. The company remains open to increasing its $7.50 per share offer and potentially adding a material cash component if the company’s leadership chooses to engage in good faith discussions.

Tejon Ranch Co. (TRC) | Real Estate Operating Companies | $16.31 | $438.4mm

Proxy Fight: Announced that, based on the final vote count certified by the independent election inspector, shareholders have voted to re-elect the vast majority of incumbent directors, while also electing Andrew Dakos, Principal & Partner at Bulldog Investors. The newly elected director believes the stock substantially undervalues the company’s assets. In response, Glenbrook Capital Management, a long-time shareholder owning ~1.1% of the company’s outstanding shares, urged the Board to adopt PFS Trust’s shareholder proposal, which would allow shareholders holding a combined 10% of outstanding shares to call a special meeting. Glenbrook also questioned the timing and motive behind the company’s quiet filing of a $200mm shelf offering, just three days after the annual meeting and before the newly constituted board could properly evaluate it, citing a history of insider participation in rights offerings that led to public shareholder dilution.

Interactive Strength Inc. (TRNR) | Leisure Products | $0.79 | $8.0mm

Business Update: Raised 2025 pro forma revenue guidance to over $75mm, representing a more than 15% increase from the April guidance of $65mm, driven by strong Q1 performance across TRNR, Sportstech, and Wattbike. While the Sportstech and Wattbike acquisitions have not yet formally closed and are not reflected in reported financials, the businesses are operating as a unified group. On a pro forma basis, Q1 revenue exceeded $20mm, with the company now expecting to achieve positive adj. EBITDA in Q4, having been close to breakeven in Q1.

Unifi, Inc. (UFI) | Textiles | $4.93 | $90.5mm

Asset Sale: Sold its manufacturing facility in Madison, North Carolina, to a third-party buyer for $45.0mm. Of the net proceeds, $25.0mm was used to reduce the existing term loan and $18.3mm to reduce outstanding revolving loans. This lowered the term loan balance to $67.0mm and the revolving loan balance to $5.6mm, reducing total debt principal by ~$43.3mm. The facility closure is expected to drive higher utilization and more efficient operations in the Americas segment, with anticipated annualized operating cost savings of over $20.0mm once all transition and restructuring activities are complete.

United Homes Group, Inc. (UHG) | Residential Construction | $2.10 | $123.1mm

Management Change: Appointed John G. (Jack) Micenko, Jr. as CEO, while simultaneously initiating a review of strategic alternatives to explore opportunities to maximize shareholder value. The review will consider a range of potential options, including a sale of the company, a sale of assets, refinancing existing indebtedness, among others. He succeeds James M. (Jamie) Pirrello, who served as Interim CEO. Jack was a key member of the team that took the company public and became President shortly after the successful transaction. He brings over 20 years of experience in equity and capital markets. Most recently, he was a Managing Director at BTIG, where he led the firm’s Housing Ecosystem investment banking practice. Prior to BTIG, he held similar roles at Susquehanna International Group, Lehman Brothers, and Friedman Billings Ramsey Group.

Visionstate Corp. (VSSS.F) | Application Software | $0.03 | $5.6mm

Business Update: Reported an immediate and accelerating surge in demand for its WandaLITE solution, driven by Ontario’s newly passed Bill 190, which mandates the display and tracking of restroom cleaning schedules in public-facing businesses and institutions. Adoption is already underway, with a major Ontario municipality and a large hospital among the first to implement the platform. The legislation, which impacts tens of thousands of businesses across the province, represents a major shift toward transparency and accountability in public hygiene, with enforcement expected to ramp up through the remainder of 2025. Priced at an annual fee of $960 per installation, the revenue opportunity is substantial, with the company targeting 1,000 installs by year-end.

Zevra Therapeutics, Inc. (ZVRA) | Pharmaceuticals | $8.65 | $473.0mm

Proxy Fight: Urged shareholders to re-elect two independent directors, Wendy L. Dixon, Ph.D., and Tamara A. Favorito, while opposing dissident stockholder Daniel Mangless’ attempt to secure two additional board seats for his nominees. Mangless, who already holds three seats on the eight-member board, argues for a “fresh perspective.” All three leading proxy advisory firms recommended voting in favor of the company’s nominees, citing insufficient qualifications of Mangless’ nominees and concerns over potential risks to the company’s governance stability.

Download the PDF version by clicking the button below.

Thanks for reading and spreading the word. If you have any questions or feedback, don't hesitate to reach out via email at info@byronstreetresearch.com.

Until next time,

Byron Street Research