Catalyst Watch #15

This Week’s Most Actionable Press Releases & 8-K Filings

Three Quick Updates

First, Catalyst Watch now covers all of North America, including Canada. Starting next week, it will also feature an Earnings Watch section, highlighting the most interesting earnings reports and transcripts, alongside press releases and 8-Ks.

Second, few things are more frustrating than a stock doubling before you hit publish. To prevent that from happening again, I’ll soon introduce a new one-pager format for ideas with near-term catalysts. Same deep research process, just faster delivery.

Finally, a new era begins next week with the first Quarterly Performance Review. Several write-ups will be dropped from coverage. Only a select few now meet my higher bar. Targeted multibagger hit ratio: 50%+. Stay tuned.

Scroll down to continue reading this week’s most actionable corporate events in HTML format. For all past setups, please refer to the PDF file at the end.

This Week’s Most Actionable Corporate Events

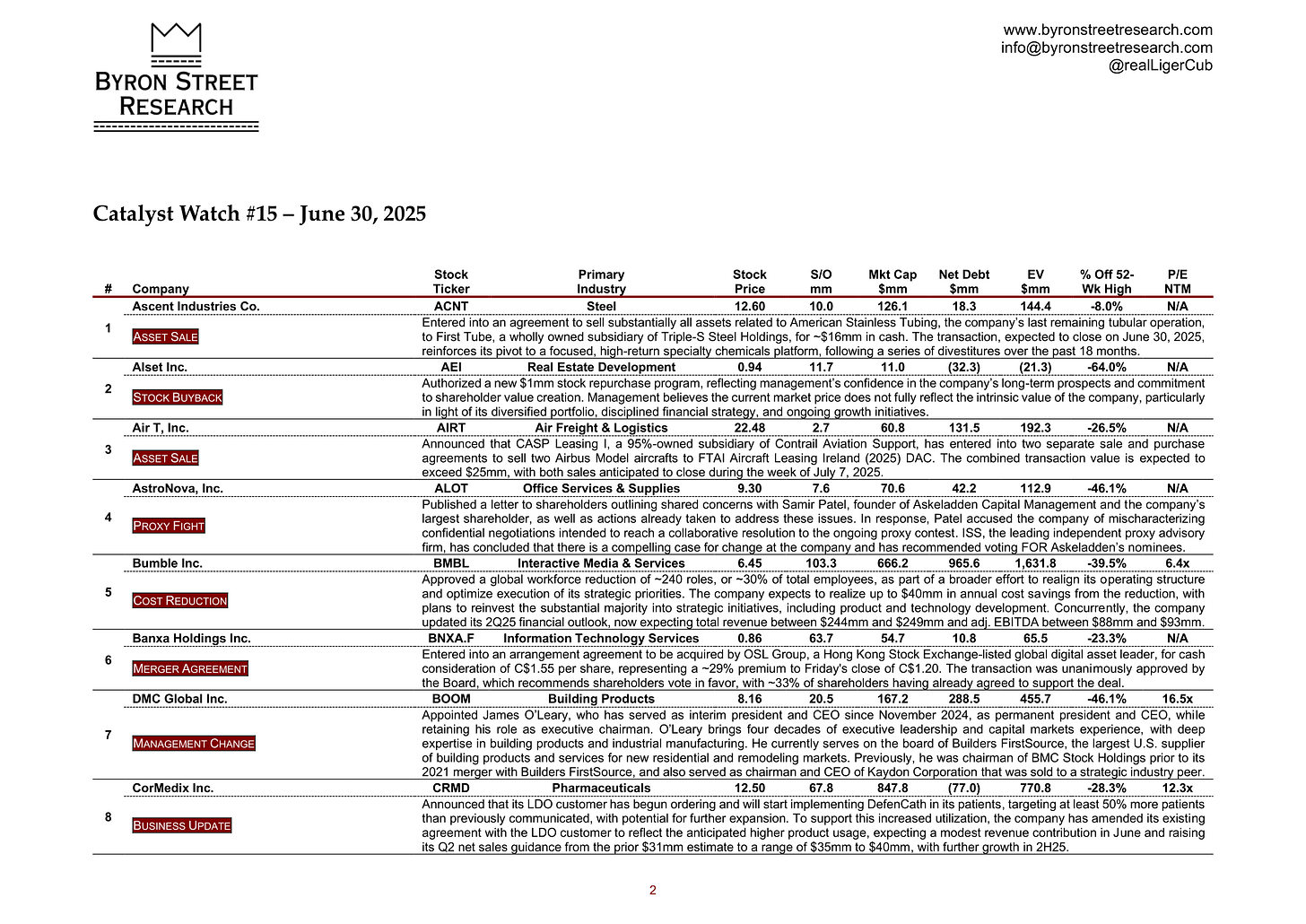

Ascent Industries Co. (ACNT) | Steel | $12.60 | $126.1mm

Asset Sale: Entered into an agreement to sell substantially all assets related to American Stainless Tubing, the company’s last remaining tubular operation, to First Tube, a wholly owned subsidiary of Triple-S Steel Holdings, for ~$16mm in cash. The transaction, expected to close on June 30, 2025, reinforces its pivot to a focused, high-return specialty chemicals platform, following a series of divestitures over the past 18 months.

Alset Inc. (AEI) | Real Estate Development | $0.94 | $11.0mm

Stock Buyback: Authorized a new $1mm stock repurchase program, reflecting management’s confidence in the company’s long-term prospects and commitment to shareholder value creation. Management believes the current market price does not fully reflect the intrinsic value of the company, particularly in light of its diversified portfolio, disciplined financial strategy, and ongoing growth initiatives.

Air T, Inc. (AIRT) | Air Freight & Logistics | $22.48 | $60.8mm

Asset Sale: Announced that CASP Leasing I, a 95%-owned subsidiary of Contrail Aviation Support, has entered into two separate sale and purchase agreements to sell two Airbus Model aircrafts to FTAI Aircraft Leasing Ireland (2025) DAC. The combined transaction value is expected to exceed $25mm, with both sales anticipated to close during the week of July 7, 2025.

AstroNova, Inc. (ALOT) | Office Services & Supplies | $9.30 | $70.6mm

Proxy Fight: Published a letter to shareholders outlining shared concerns with Samir Patel, founder of Askeladden Capital Management and the company’s largest shareholder, as well as actions already taken to address these issues. In response, Patel accused the company of mischaracterizing confidential negotiations intended to reach a collaborative resolution to the ongoing proxy contest. ISS, the leading independent proxy advisory firm, has concluded that there is a compelling case for change at the company and has recommended voting FOR Askeladden’s nominees.

Bumble Inc. (BMBL) | Interactive Media & Services | $6.45 | $666.2mm

Cost Reduction: Approved a global workforce reduction of ~240 roles, or ~30% of total employees, as part of a broader effort to realign its operating structure and optimize execution of its strategic priorities. The company expects to realize up to $40mm in annual cost savings from the reduction, with plans to reinvest the substantial majority into strategic initiatives, including product and technology development. Concurrently, the company updated its 2Q25 financial outlook, now expecting total revenue between $244mm and $249mm and adj. EBITDA between $88mm and $93mm.

Banxa Holdings Inc. (BNXA.F) | Information Technology Services | $0.86 | $54.7mm

Merger Agreement: Entered into an arrangement agreement to be acquired by OSL Group, a Hong Kong Stock Exchange-listed global digital asset leader, for cash consideration of C$1.55 per share, representing a ~29% premium to Friday's close of C$1.20. The transaction was unanimously approved by the Board, which recommends shareholders vote in favor, with ~33% of shareholders having already agreed to support the deal.

DMC Global Inc. (BOOM) | Building Products | $8.16 | $167.2mm

Management Change: Appointed James O’Leary, who has served as interim president and CEO since November 2024, as permanent president and CEO, while retaining his role as executive chairman. O’Leary brings four decades of executive leadership and capital markets experience, with deep expertise in building products and industrial manufacturing. He currently serves on the board of Builders FirstSource, the largest U.S. supplier of building products and services for new residential and remodeling markets. Previously, he was chairman of BMC Stock Holdings prior to its 2021 merger with Builders FirstSource, and also served as chairman and CEO of Kaydon Corporation that was sold to a strategic industry peer.

CorMedix Inc. (CRMD) | Pharmaceuticals | $12.50 | $847.8mm

Business Update: Announced that its LDO customer has begun ordering and will start implementing DefenCath in its patients, targeting at least 50% more patients than previously communicated, with potential for further expansion. To support this increased utilization, the company has amended its existing agreement with the LDO customer to reflect the anticipated higher product usage, expecting a modest revenue contribution in June and raising its Q2 net sales guidance from the prior $31mm estimate to a range of $35mm to $40mm, with further growth in 2H25.