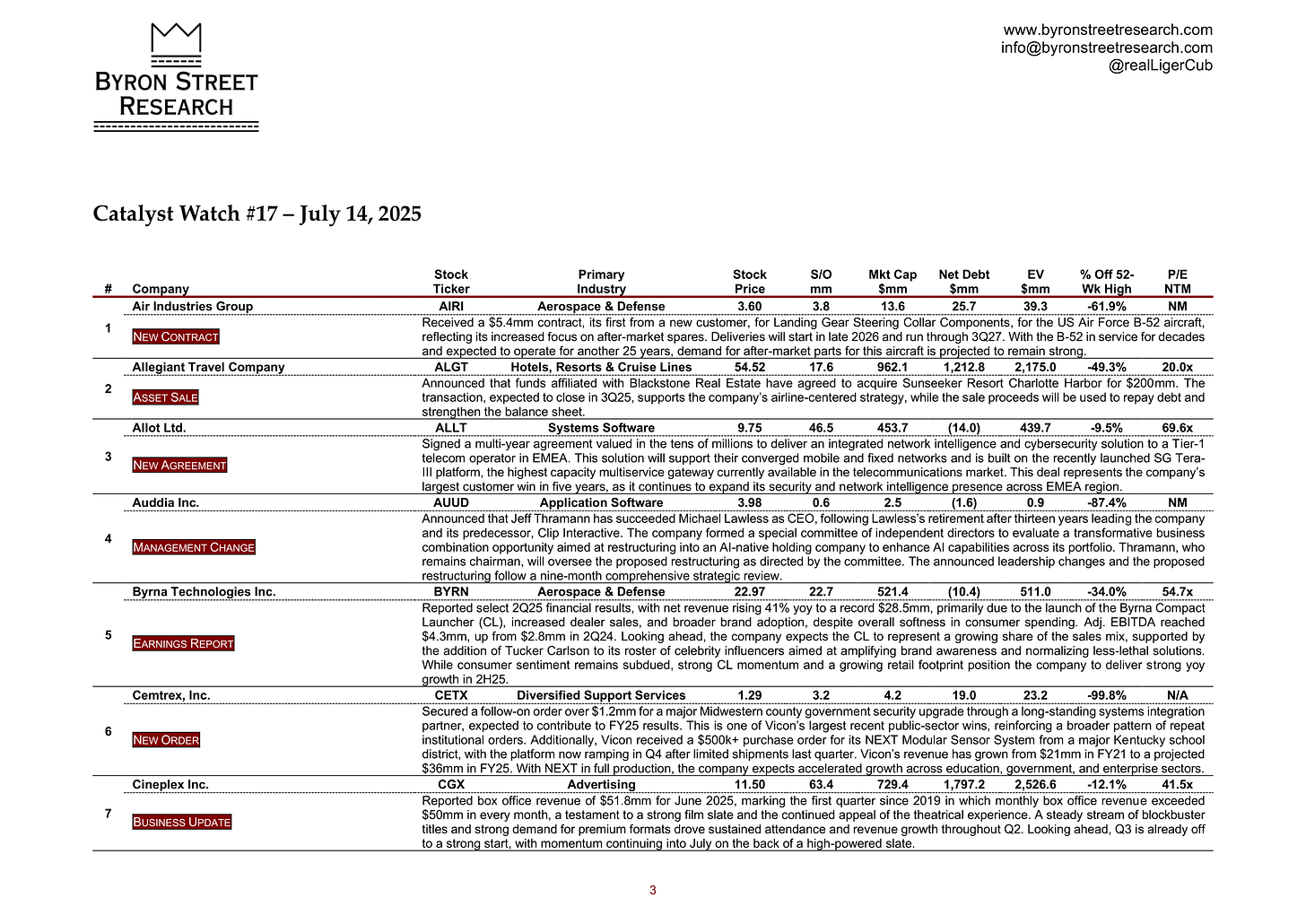

Catalyst Watch #17

This Week’s Most Actionable Press Releases, 8-K Filings, Earnings Reports & Call Transcripts

Scroll down to continue reading this week’s most actionable corporate events in HTML format. For all past setups, please refer to the PDF file at the end.

This Week’s Most Actionable Corporate Events

Air Industries Group (AIRI) | Aerospace & Defense | $3.60 | $13.6mm

New Contract: Received a $5.4mm contract, its first from a new customer, for Landing Gear Steering Collar Components, for the US Air Force B-52 aircraft, reflecting its increased focus on after-market spares. Deliveries will start in late 2026 and run through 3Q27. With the B-52 in service for decades and expected to operate for another 25 years, demand for after-market parts for this aircraft is projected to remain strong.

Allegiant Travel Company (ALGT) | Hotels, Resorts & Cruise Lines | $54.52 | $962.1mm

Asset Sale: Announced that funds affiliated with Blackstone Real Estate have agreed to acquire Sunseeker Resort Charlotte Harbor for $200mm. The transaction, expected to close in 3Q25, supports the company’s airline-centered strategy, while the sale proceeds will be used to repay debt and strengthen the balance sheet.

Allot Ltd. (ALLT) | Systems Software | $9.75 | $453.7mm

New Agreement: Signed a multi-year agreement valued in the tens of millions to deliver an integrated network intelligence and cybersecurity solution to a Tier-1 telecom operator in EMEA. This solution will support their converged mobile and fixed networks and is built on the recently launched SG TeraIII platform, the highest capacity multiservice gateway currently available in the telecommunications market. This deal represents the company’s largest customer win in five years, as it continues to expand its security and network intelligence presence across EMEA region.

Auddia Inc. (AUUD) | Application Software | $3.98 | $2.5mm

Management Change: Announced that Jeff Thramann has succeeded Michael Lawless as CEO, following Lawless’s retirement after thirteen years leading the company and its predecessor, Clip Interactive. The company formed a special committee of independent directors to evaluate a transformative business combination opportunity aimed at restructuring into an AI-native holding company to enhance AI capabilities across its portfolio. Thramann, who remains chairman, will oversee the proposed restructuring as directed by the committee. The announced leadership changes and the proposed restructuring follow a nine-month comprehensive strategic review.

Byrna Technologies Inc. (BYRN) | Aerospace & Defense | $22.97 | $521.4mm

Earnings Report: Reported select 2Q25 financial results, with net revenue rising 41% yoy to a record $28.5mm, primarily due to the launch of the Byrna Compact Launcher (CL), increased dealer sales, and broader brand adoption, despite overall softness in consumer spending. Adj. EBITDA reached $4.3mm, up from $2.8mm in 2Q24. Looking ahead, the company expects the CL to represent a growing share of the sales mix, supported by the addition of Tucker Carlson to its roster of celebrity influencers aimed at amplifying brand awareness and normalizing less-lethal solutions. While consumer sentiment remains subdued, strong CL momentum and a growing retail footprint position the company to deliver strong yoy growth in 2H25.

Cemtrex, Inc. (CETX) | Diversified Support Services | $1.29 | $4.2mm

New Order: Secured a follow-on order over $1.2mm for a major Midwestern county government security upgrade through a long-standing systems integration partner, expected to contribute to FY25 results. This is one of Vicon’s largest recent public-sector wins, reinforcing a broader pattern of repeat institutional orders. Additionally, Vicon received a $500k+ purchase order for its NEXT Modular Sensor System from a major Kentucky school district, with the platform now ramping in Q4 after limited shipments last quarter. Vicon’s revenue has grown from $21mm in FY21 to a projected $36mm in FY25. With NEXT in full production, the company expects accelerated growth across education, government, and enterprise sectors.

Cineplex Inc. (CGX) | Advertising | $11.50 | $729.4mm

Business Update: Reported box office revenue of $51.8mm for June 2025, marking the first quarter since 2019 in which monthly box office revenue exceeded $50mm in every month, a testament to a strong film slate and the continued appeal of the theatrical experience. A steady stream of blockbuster titles and strong demand for premium formats drove sustained attendance and revenue growth throughout Q2. Looking ahead, Q3 is already off to a strong start, with momentum continuing into July on the back of a high-powered slate.