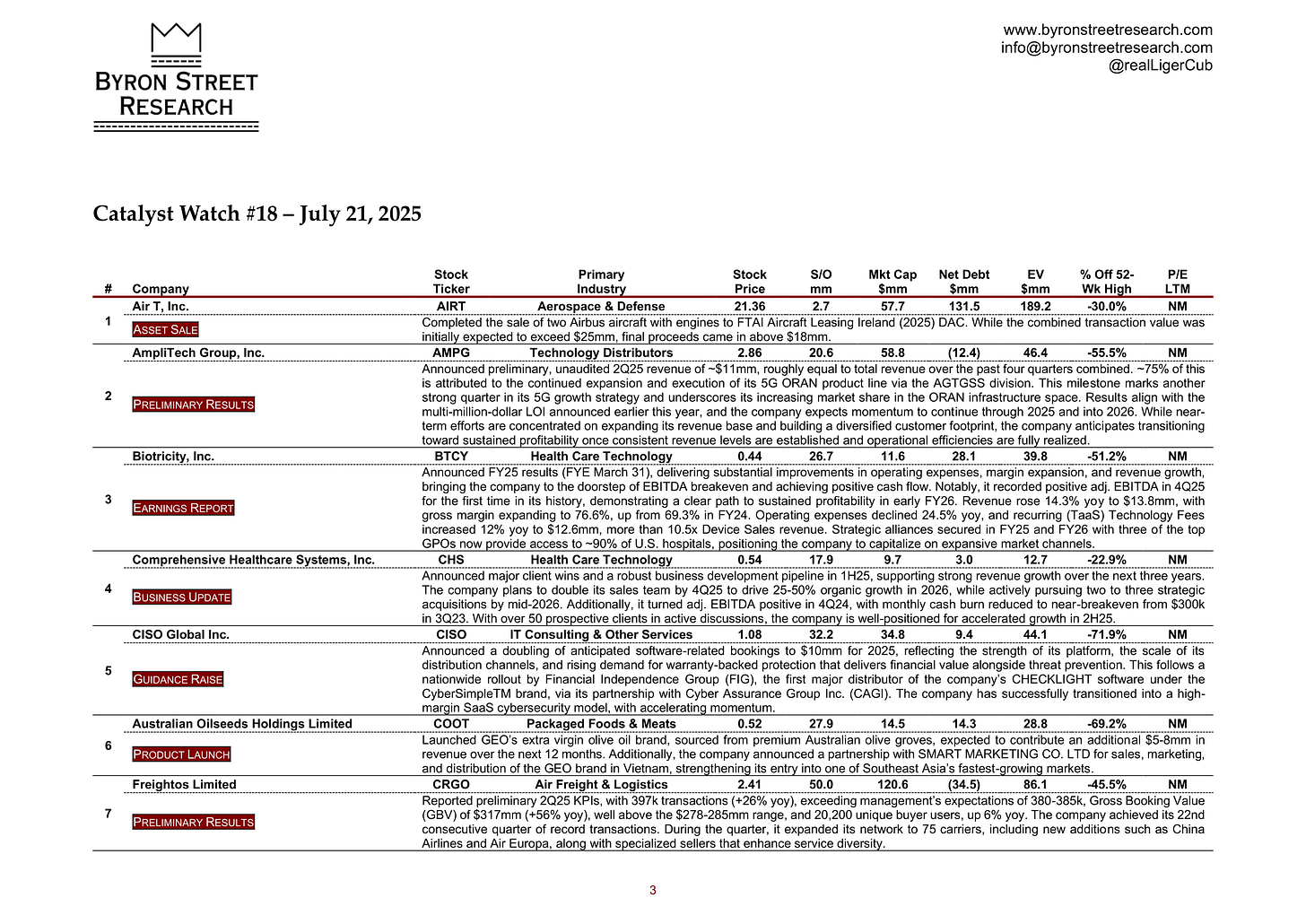

Catalyst Watch #18

This Week’s Most Actionable Press Releases, 8-K Filings, Earnings Reports & Call Transcripts

Q2 2025 performance review drops this week with updates on all write-ups, including one where disclosed contractual targets point to a revenue beat in the upcoming earnings release. Hint: it’s covered below too.

Scroll down to continue reading this week’s most actionable corporate events in HTML format. For all past setups, please refer to the PDF file at the end.

This Week’s Most Actionable Corporate Events

Air T, Inc. (AIRT) | Aerospace & Defense | $21.36 | $57.7mm

Asset Sale: Completed the sale of two Airbus aircraft with engines to FTAI Aircraft Leasing Ireland (2025) DAC. While the combined transaction value was initially expected to exceed $25mm, final proceeds came in above $18mm.

AmpliTech Group, Inc. (AMPG) | Technology Distributors | $2.86 | $58.8mm

Preliminary Results: Announced preliminary, unaudited 2Q25 revenue of ~$11mm, roughly equal to total revenue over the past four quarters combined. ~75% of this is attributed to the continued expansion and execution of its 5G ORAN product line via the AGTGSS division. This milestone marks another strong quarter in its 5G growth strategy and underscores its increasing market share in the ORAN infrastructure space. Results align with the multi-million-dollar LOI announced earlier this year, and the company expects momentum to continue through 2025 and into 2026. While nearterm efforts are concentrated on expanding its revenue base and building a diversified customer footprint, the company anticipates transitioning toward sustained profitability once consistent revenue levels are established and operational efficiencies are fully realized.

Biotricity, Inc. (BTCY) | Health Care Technology | $0.44 | $11.6mm

Earnings Report: Announced FY25 results (FYE March 31), delivering substantial improvements in operating expenses, margin expansion, and revenue growth, bringing the company to the doorstep of EBITDA breakeven and achieving positive cash flow. Notably, it recorded positive adj. EBITDA in 4Q25 for the first time in its history, demonstrating a clear path to sustained profitability in early FY26. Revenue rose 14.3% yoy to $13.8mm, with gross margin expanding to 76.6%, up from 69.3% in FY24. Operating expenses declined 24.5% yoy, and recurring (TaaS) Technology Fees increased 12% yoy to $12.6mm, more than 10.5x Device Sales revenue. Strategic alliances secured in FY25 and FY26 with three of the top GPOs now provide access to ~90% of U.S. hospitals, positioning the company to capitalize on expansive market channels.

Comprehensive Healthcare Systems, Inc. (CHS) | Health Care Technology | $0.54 | $9.7mm

Business Update: Announced major client wins and a robust business development pipeline in 1H25, supporting strong revenue growth over the next three years. The company plans to double its sales team by 4Q25 to drive 25-50% organic growth in 2026, while actively pursuing two to three strategic acquisitions by mid-2026. Additionally, it turned adj. EBITDA positive in 4Q24, with monthly cash burn reduced to near-breakeven from $300k in 3Q23. With over 50 prospective clients in active discussions, the company is well-positioned for accelerated growth in 2H25.

CISO Global Inc. (CISO) | IT Consulting & Other Services | $1.08 | $34.8mm

Guidance Raise: Announced a doubling of anticipated software-related bookings to $10mm for 2025, reflecting the strength of its platform, the scale of its distribution channels, and rising demand for warranty-backed protection that delivers financial value alongside threat prevention. This follows a nationwide rollout by Financial Independence Group (FIG), the first major distributor of the company’s CHECKLIGHT software under the CyberSimpleTM brand, via its partnership with Cyber Assurance Group Inc. (CAGI). The company has successfully transitioned into a high-margin SaaS cybersecurity model, with accelerating momentum.

Australian Oilseeds Holdings Limited (COOT) | Packaged Foods & Meats | $0.52 | $14.5mm

Product Launch: Launched GEO’s extra virgin olive oil brand, sourced from premium Australian olive groves, expected to contribute an additional $5-8mm in revenue over the next 12 months. Additionally, the company announced a partnership with SMART MARKETING CO. LTD for sales, marketing, and distribution of the GEO brand in Vietnam, strengthening its entry into one of Southeast Asia’s fastest-growing markets.

Freightos Limited (CRGO) | Air Freight & Logistics | $2.41 | $120.6mm

Preliminary Results: Reported preliminary 2Q25 KPIs, with 397k transactions (+26% yoy), exceeding management’s expectations of 380-385k, Gross Booking Value (GBV) of $317mm (+56% yoy), well above the $278-285mm range, and 20,200 unique buyer users, up 6% yoy. The company achieved its 22nd consecutive quarter of record transactions. During the quarter, it expanded its network to 75 carriers, including new additions such as China Airlines and Air Europa, along with specialized sellers that enhance service diversity.