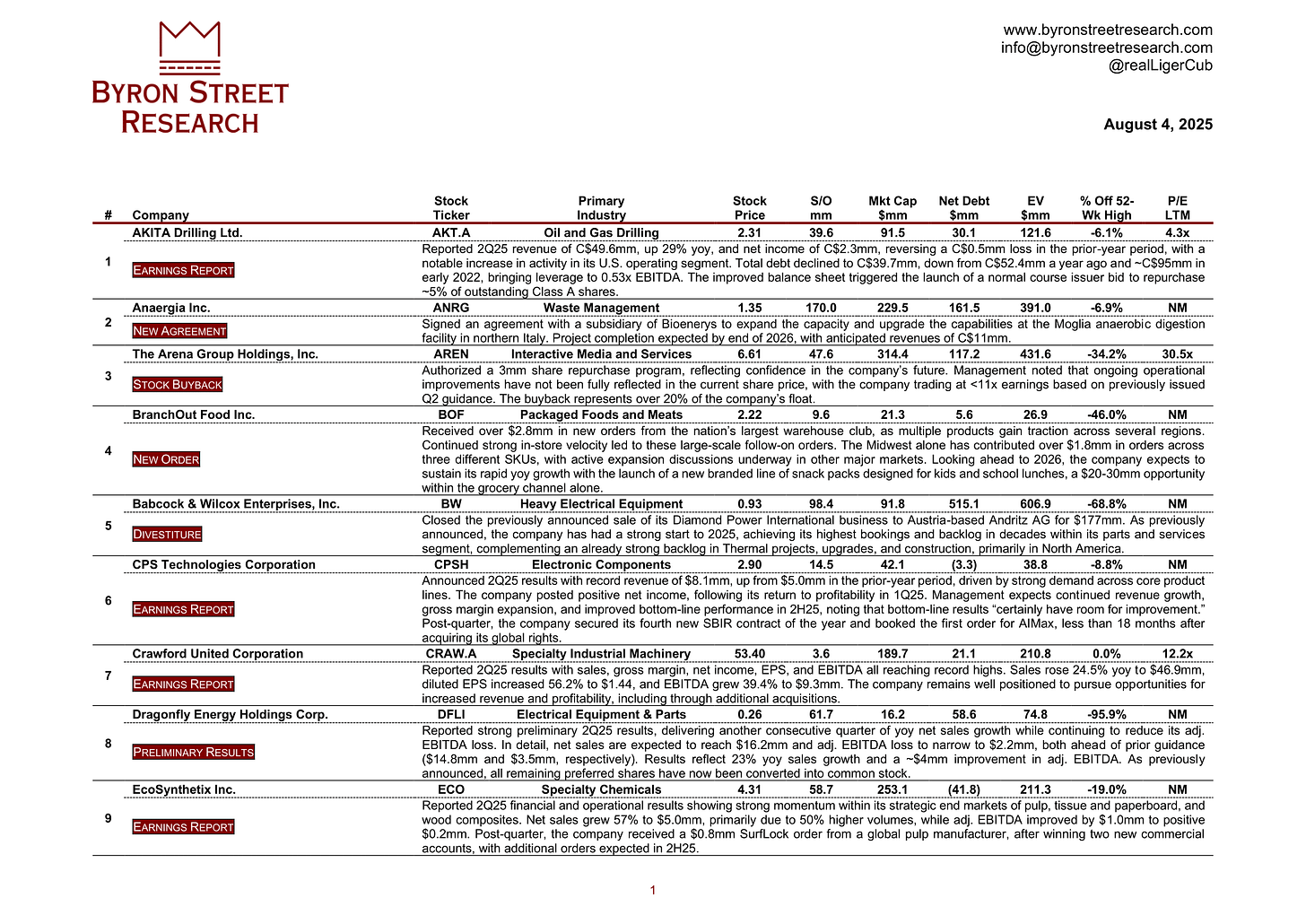

Catalyst Watch #20

This Week’s Most Actionable Press Releases, 8-K Filings, Earnings Reports & Call Transcripts

The next write-up is coming soon, likely this Thursday. As with my last one, accounting rules have distorted the picture, but this time, the inflection extends beyond just growth.

Scroll down to continue reading this week’s most actionable corporate events in HTML format. For all past setups, please refer to the PDF file at the end.

This Week’s Most Actionable Corporate Events

AKITA Drilling Ltd. (AKT.A) | Oil and Gas Drilling | $2.31 | $91.5mm

Earnings Report: Reported 2Q25 revenue of C$49.6mm, up 29% yoy, and net income of C$2.3mm, reversing a C$0.5mm loss in the prior-year period, with a notable increase in activity in its U.S. operating segment. Total debt declined to C$39.7mm, down from C$52.4mm a year ago and ~C$95mm in early 2022, bringing leverage to 0.53x EBITDA. The improved balance sheet triggered the launch of a normal course issuer bid to repurchase ~5% of outstanding Class A shares.

Anaergia Inc. (ANRG) | Waste Management | $1.35 | $229.5mm

New Agreement: Signed an agreement with a subsidiary of Bioenerys to expand the capacity and upgrade the capabilities at the Moglia anaerobic digestion facility in northern Italy. Project completion expected by end of 2026, with anticipated revenues of C$11mm.

The Arena Group Holdings, Inc. (AREN) | Interactive Media and Services | $6.61 | $314.4mm

Stock Buyback: Authorized a 3mm share repurchase program, reflecting confidence in the company’s future. Management noted that ongoing operational improvements have not been fully reflected in the current share price, with the company trading at <11x earnings based on previously issued Q2 guidance. The buyback represents over 20% of the company’s float.

BranchOut Food Inc. (BOF) | Packaged Foods and Meats | $2.22 | $21.3mm

New Order: Received over $2.8mm in new orders from the nation’s largest warehouse club, as multiple products gain traction across several regions. Continued strong in-store velocity led to these large-scale follow-on orders. The Midwest alone has contributed over $1.8mm in orders across three different SKUs, with active expansion discussions underway in other major markets. Looking ahead to 2026, the company expects to sustain its rapid yoy growth with the launch of a new branded line of snack packs designed for kids and school lunches, a $20-30mm opportunity within the grocery channel alone.

Babcock & Wilcox Enterprises, Inc. (BW) | Heavy Electrical Equipment | $0.93 | $91.8mm

Divestiture: Closed the previously announced sale of its Diamond Power International business to Austria-based Andritz AG for $177mm. As previously announced, the company has had a strong start to 2025, achieving its highest bookings and backlog in decades within its parts and services segment, complementing an already strong backlog in Thermal projects, upgrades, and construction, primarily in North America.