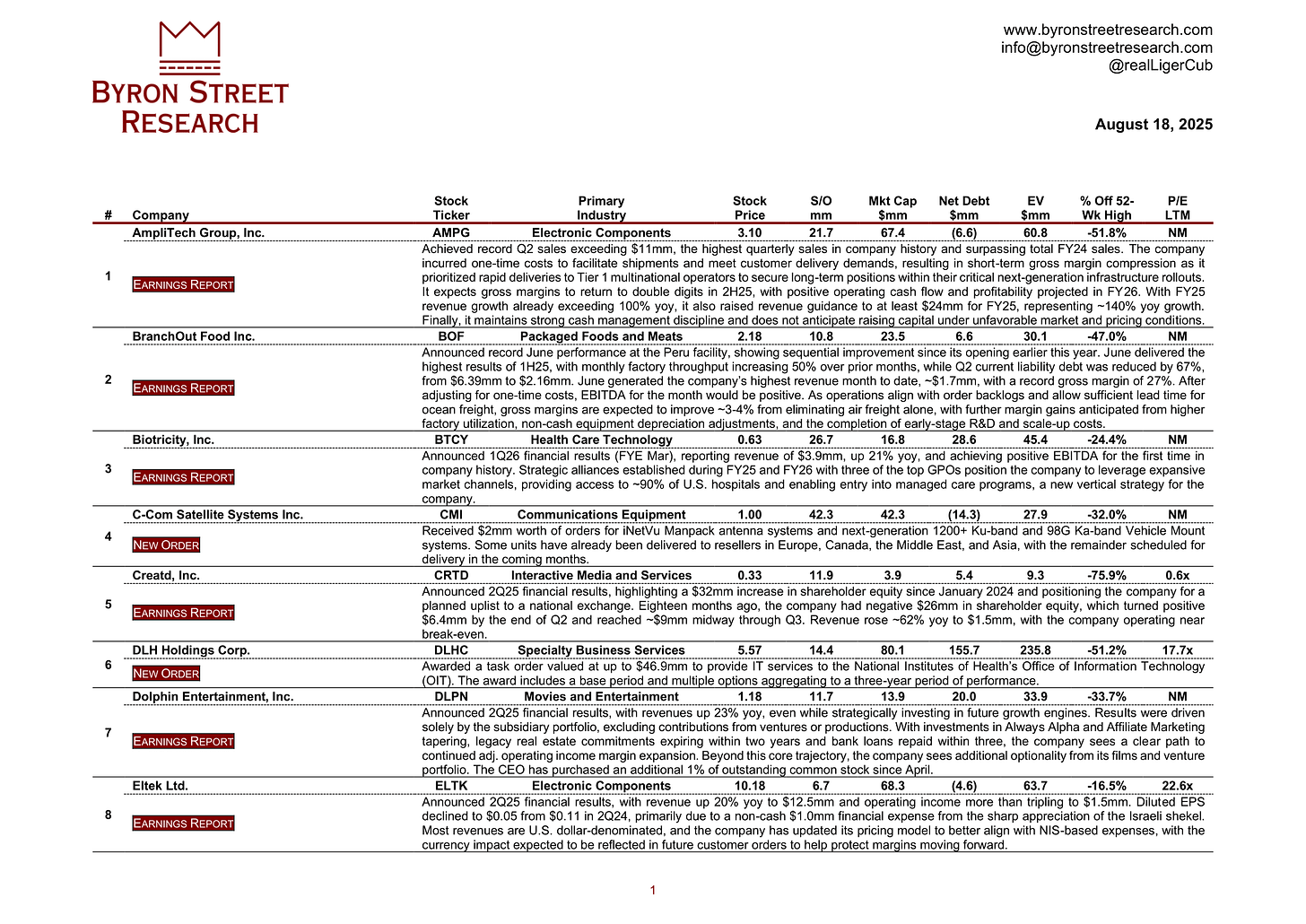

Catalyst Watch #22

This Week’s Most Actionable Microcap Press Releases (U.S. & Canada)

This Week’s Most Actionable Corporate Events

AmpliTech Group, Inc. (AMPG) | Electronic Components | $3.10 | $67.4mm

Earnings Report: Achieved record Q2 sales exceeding $11mm, the highest quarterly sales in company history and surpassing total FY24 sales. The company incurred one-time costs to facilitate shipments and meet customer delivery demands, resulting in short-term gross margin compression as it prioritized rapid deliveries to Tier 1 multinational operators to secure long-term positions within their critical next-generation infrastructure rollouts. It expects gross margins to return to double digits in 2H25, with positive operating cash flow and profitability projected in FY26. With FY25 revenue growth already exceeding 100% yoy, it also raised revenue guidance to at least $24mm for FY25, representing ~140% yoy growth. Finally, it maintains strong cash management discipline and does not anticipate raising capital under unfavorable market and pricing conditions.

BranchOut Food Inc. (BOF) | Packaged Foods and Meats | $2.18 | $23.5mm

Earnings Report: Announced record June performance at the Peru facility, showing sequential improvement since its opening earlier this year. June delivered the highest results of 1H25, with monthly factory throughput increasing 50% over prior months, while Q2 current liability debt was reduced by 67%, from $6.39mm to $2.16mm. June generated the company’s highest revenue month to date, ~$1.7mm, with a record gross margin of 27%. After adjusting for one-time costs, EBITDA for the month would be positive. As operations align with order backlogs and allow sufficient lead time for ocean freight, gross margins are expected to improve ~3-4% from eliminating air freight alone, with further margin gains anticipated from higher factory utilization, non-cash equipment depreciation adjustments, and the completion of early-stage R&D and scale-up costs.