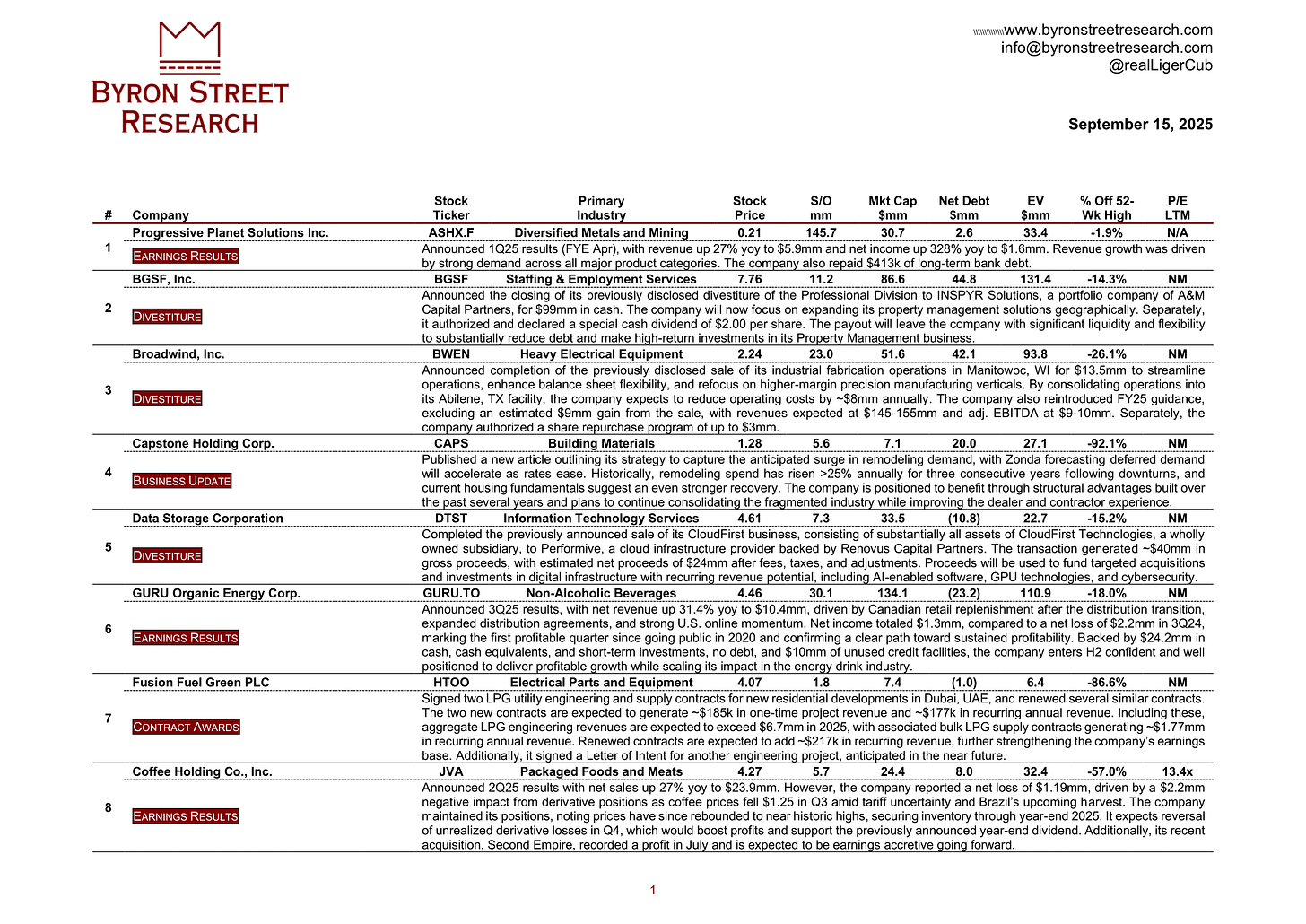

Catalyst Watch #26

This Week’s Most Actionable Microcap Press Releases in North America

This Week’s Most Actionable Corporate Events

Progressive Planet Solutions Inc. (ASHX.F) | Diversified Metals and Mining | $0.21 | $30.7mm

Earnings Results: Announced 1Q25 results (FYE Apr), with revenue up 27% yoy to $5.9mm and net income up 328% yoy to $1.6mm. Revenue growth was driven by strong demand across all major product categories. The company also repaid $413k of long-term bank debt.

BGSF, Inc. (BGSF) | Staffing & Employment Services | $7.76 | $86.6mm

Divestiture: Announced the closing of its previously disclosed divestiture of the Professional Division to INSPYR Solutions, a portfolio company of A&M Capital Partners, for $99mm in cash. The company will now focus on expanding its property management solutions geographically. Separately, it authorized and declared a special cash dividend of $2.00 per share. The payout will leave the company with significant liquidity and flexibility to substantially reduce debt and make high-return investments in its Property Management business.

Broadwind, Inc. (BWEN) | Heavy Electrical Equipment | $2.24 | $51.6mm

Divestiture: Announced completion of the previously disclosed sale of its industrial fabrication operations in Manitowoc, WI for $13.5mm to streamline operations, enhance balance sheet flexibility, and refocus on higher-margin precision manufacturing verticals. By consolidating operations into its Abilene, TX facility, the company expects to reduce operating costs by ~$8mm annually. The company also reintroduced FY25 guidance, excluding an estimated $9mm gain from the sale, with revenues expected at $145-155mm and adj. EBITDA at $9-10mm. Separately, the company authorized a share repurchase program of up to $3mm.

Capstone Holding Corp. (CAPS) | Building Materials | $1.28 | $7.1mm

Business Update: Published a new article outlining its strategy to capture the anticipated surge in remodeling demand, with Zonda forecasting deferred demand will accelerate as rates ease. Historically, remodeling spend has risen >25% annually for three consecutive years following downturns, and current housing fundamentals suggest an even stronger recovery. The company is positioned to benefit through structural advantages built over the past several years and plans to continue consolidating the fragmented industry while improving the dealer and contractor experience.

Data Storage Corporation (DTST) | Information Technology Services | $4.61 | $33.5mm

Divestiture: Completed the previously announced sale of its CloudFirst business, consisting of substantially all assets of CloudFirst Technologies, a wholly owned subsidiary, to Performive, a cloud infrastructure provider backed by Renovus Capital Partners. The transaction generated ~$40mm in gross proceeds, with estimated net proceeds of $24mm after fees, taxes, and adjustments. Proceeds will be used to fund targeted acquisitions and investments in digital infrastructure with recurring revenue potential, including AI-enabled software, GPU technologies, and cybersecurity.