Catalyst Watch #27

(+ Important Update) This Week’s Most Actionable Microcap Press Releases in North America

Starting today, I’ll be rolling out a series of upgrades designed to accelerate the pace of new write-ups. With my investment universe now restricted to sub-$100mm market caps in North America, I’ve spent the past several weeks tailoring my process to microcaps. That exercise, while always open to further improvement, is now complete.

For context, the last pick, a short-term inflection play, is already up 30%+. The previous five microcap write-ups have all been on a multibagger run, including FTCI, IDN, CURI, and NURS.V, with the exception of QRHC, which is currently behaving like a typical dead-money turnaround.

Going forward, I’ll focus on companies that meet most of the identifiable criteria for an ideal microcap. Ideas will fall into one of five categories: compounders, turnarounds, inflections, asset plays, or special situations. The goal is to uncover companies with rapid, sustainable, profitable, and scalable growth trading at early discovery stages.

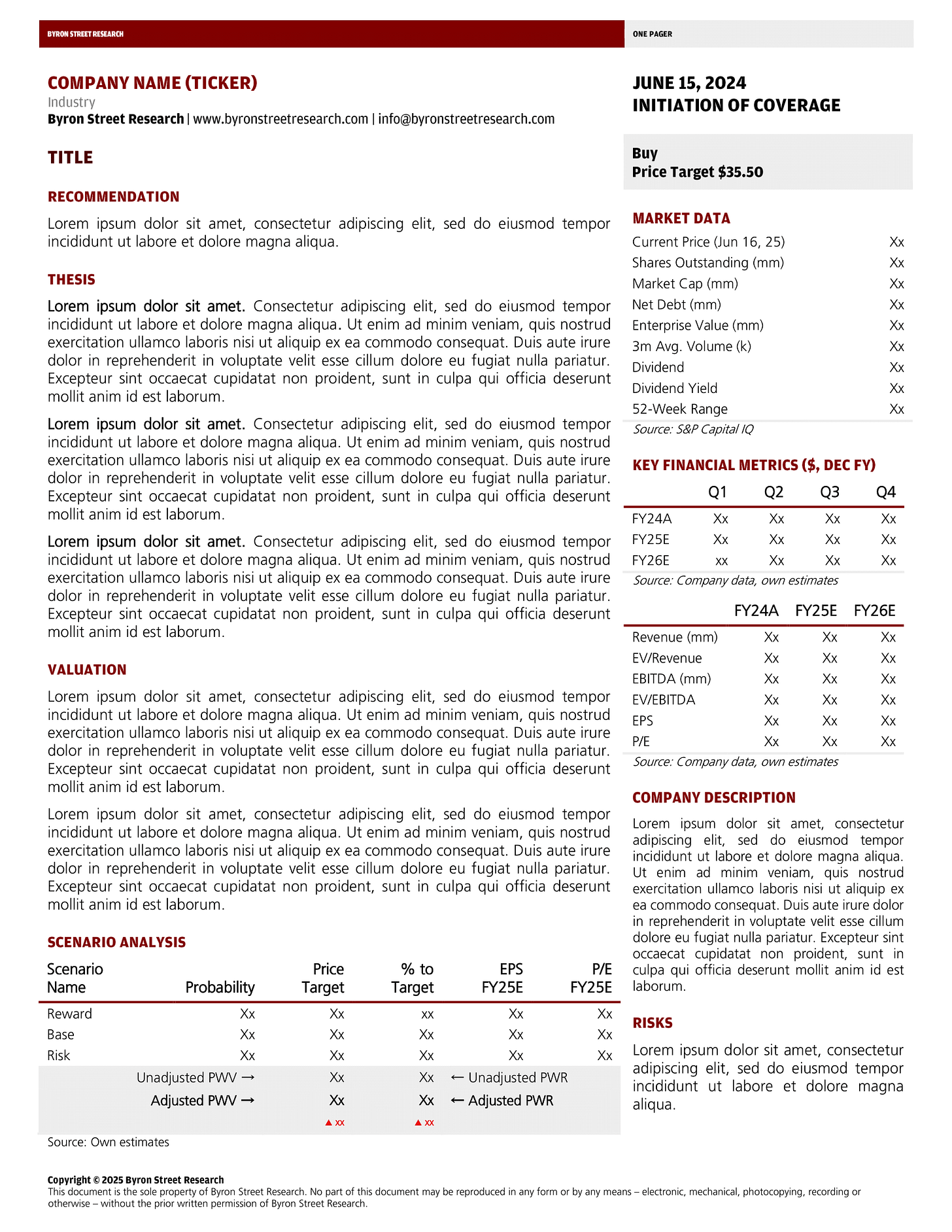

Once coverage is initiated, I’ll provide continuous earnings revisions and price target updates until the position closes, including earnings previews, reviews, and flash notes. Catalyst Watch will remain the main idea generator, with a new section soon added to the navigation panel as a searchable web-based database. Below is a snapshot of the new formats (beta).

These are a lot of updates, and I plan to make the message clearer by month-end. Stay tuned as I work on building something different, and thank you for your patience over the past few weeks of “inactivity.”

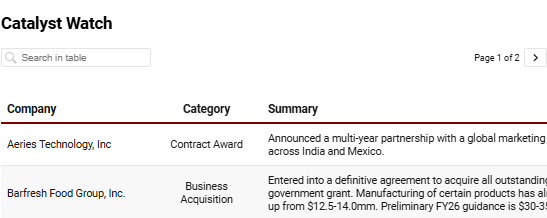

This Week’s Most Actionable Corporate Events

Aeries Technology, Inc (AERT) | Research and Consulting Services | $0.85 | $39.0mm

Contract Award: Announced a multi-year partnership with a global marketing and technology company, expected to reach up to $8mm in annual contract value, to establish its India footprint and AI delivery capabilities. This announcement builds on the momentum from the September 4 expansion plan, with plans to add 500+ new roles across India and Mexico.

Barfresh Food Group, Inc. (BRFH) | Packaged Foods and Meats | $4.04 | $64.4mm

Business Acquisition: Entered into a definitive agreement to acquire all outstanding capital stock of Arps Dairy, an Ohio-based dairy processor, for ~$1.6mm in debt repayment, funded via an increased line of credit. The company is purchasing Arps at a discount to the projected completion value of its net assets and anticipates a $2.3mm government grant. Manufacturing of certain products has already commenced at Arps’ facility, with expanded production expected immediately upon closing. Based on anticipated operational benefits and new market opportunities from the Arps acquisition, the company raised its FY25 revenue guidance to $14.5-15.5mm, up from $12.5-14.0mm. Preliminary FY26 guidance is $30-35mm, reflecting the full-year impact from enhanced manufacturing capabilities, operational synergies, and expanded market reach. The transaction is expected to close by October 1, 2025.