Catalyst Watch #30

This Week’s Most Actionable Microcap Press Releases in North America

Why Press Releases?

With larger companies, you’re looking for chaos. You want to see a battle unfolding: shorts pressing, hedge funds buying, blood in the streets. In microcaps, by contrast, you want no one in the streets at all. If you want to find truly undiscovered companies, you should focus on those that haven’t been widely covered and appeared on screeners.

By voraciously reading all news releases across major press wires as part of your daily routine, you feed ideas into your research pipeline that screeners or other investors have not yet surfaced. By monitoring events and disruptions, you spot change before it becomes consensus. This is truly the only scalable, systematic, and comprehensive approach to idea generation.

The following are just some of the corporate events Catalyst Watch tracks to build a pipeline of event-driven ideas:

And the list goes on…

In fact, there are countless ways to generate ideas: attending conferences, listening to podcasts, and reading financial magazines are just a few. But by the time an opportunity is covered in these sources, the chances are it has already been flagged in a press release.

This Week’s Most Actionable Corporate Events

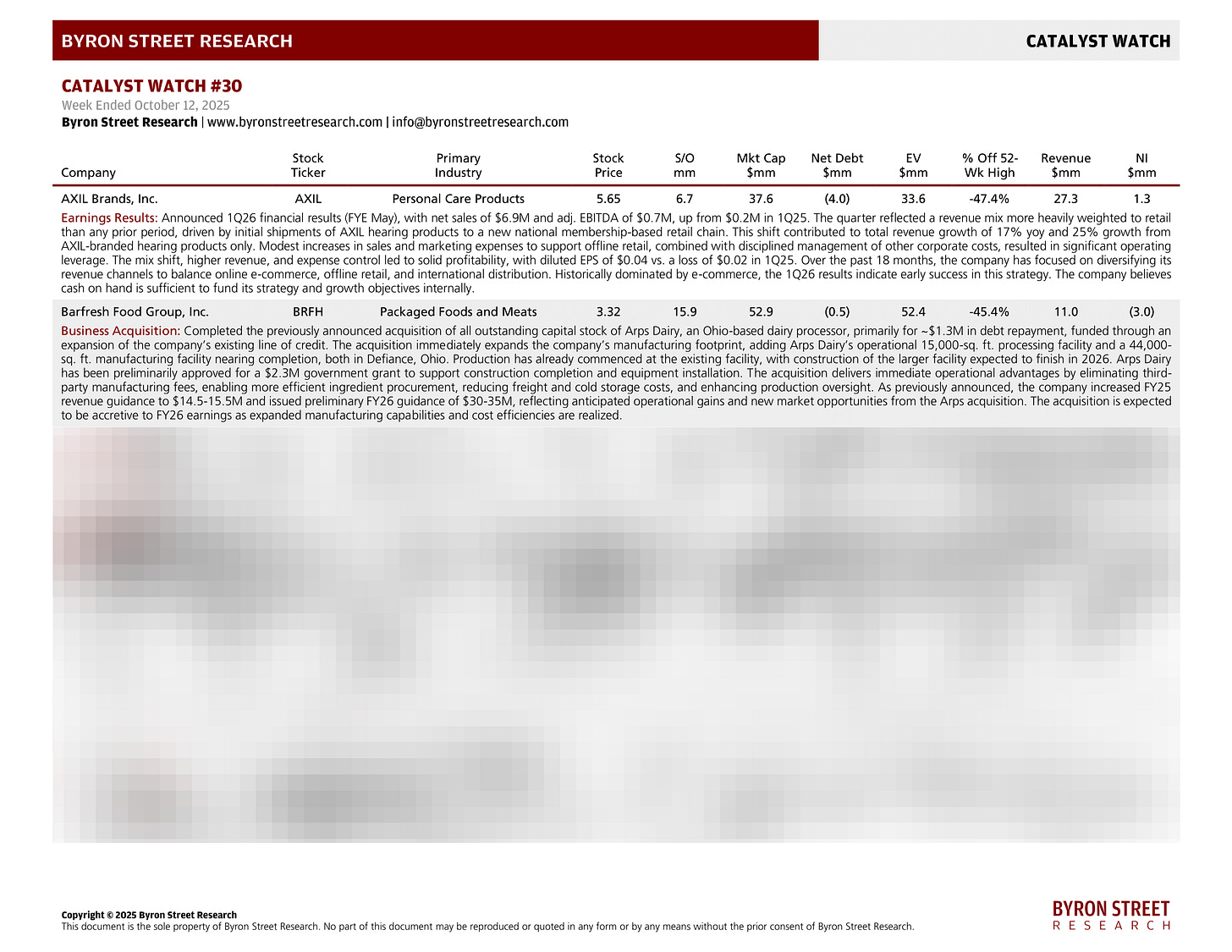

AXIL Brands, Inc. (AXIL) | Personal Care Products | $5.65 | $37.6M

Earnings Results: Announced 1Q26 financial results (FYE May), with net sales of $6.9M and adj. EBITDA of $0.7M, up from $0.2M in 1Q25. The quarter reflected a revenue mix more heavily weighted to retail than any prior period, driven by initial shipments of AXIL hearing products to a new national membership-based retail chain. This shift contributed to total revenue growth of 17% yoy and 25% growth from AXIL-branded hearing products only. Modest increases in sales and marketing expenses to support offline retail, combined with disciplined management of other corporate costs, resulted in significant operating leverage. The mix shift, higher revenue, and expense control led to solid profitability, with diluted EPS of $0.04 vs. a loss of $0.02 in 1Q25. Over the past 18 months, the company has focused on diversifying its revenue channels to balance online e-commerce, offline retail, and international distribution. Historically dominated by e-commerce, the 1Q26 results indicate early success in this strategy. The company believes cash on hand is sufficient to fund its strategy and growth objectives internally.

Barfresh Food Group, Inc. (BRFH) | Packaged Foods and Meats | $3.32 | $52.9M

Business Acquisition: Completed the previously announced acquisition of all outstanding capital stock of Arps Dairy, an Ohio-based dairy processor, primarily for ~$1.3M in debt repayment, funded through an expansion of the company’s existing line of credit. The acquisition immediately expands the company’s manufacturing footprint, adding Arps Dairy’s operational 15,000-sq. ft. processing facility and a 44,000-sq. ft. manufacturing facility nearing completion, both in Defiance, Ohio. Production has already commenced at the existing facility, with construction of the larger facility expected to finish in 2026. Arps Dairy has been preliminarily approved for a $2.3M government grant to support construction completion and equipment installation. The acquisition delivers immediate operational advantages by eliminating third-party manufacturing fees, enabling more efficient ingredient procurement, reducing freight and cold storage costs, and enhancing production oversight. As previously announced, the company increased FY25 revenue guidance to $14.5-15.5M and issued preliminary FY26 guidance of $30-35M, reflecting anticipated operational gains and new market opportunities from the Arps acquisition. The acquisition is expected to be accretive to FY26 earnings as expanded manufacturing capabilities and cost efficiencies are realized.