Catalyst Watch #32

This Week’s Most Actionable Microcap Press Releases in North America

Introduction

On Friday, we initiated coverage of CEMATRIX Corporation (CEMX.TO) with a Buy rating and a C$0.82 target price. If you missed it, you can read the report below:

Last Week’s Most Actionable Press Releases

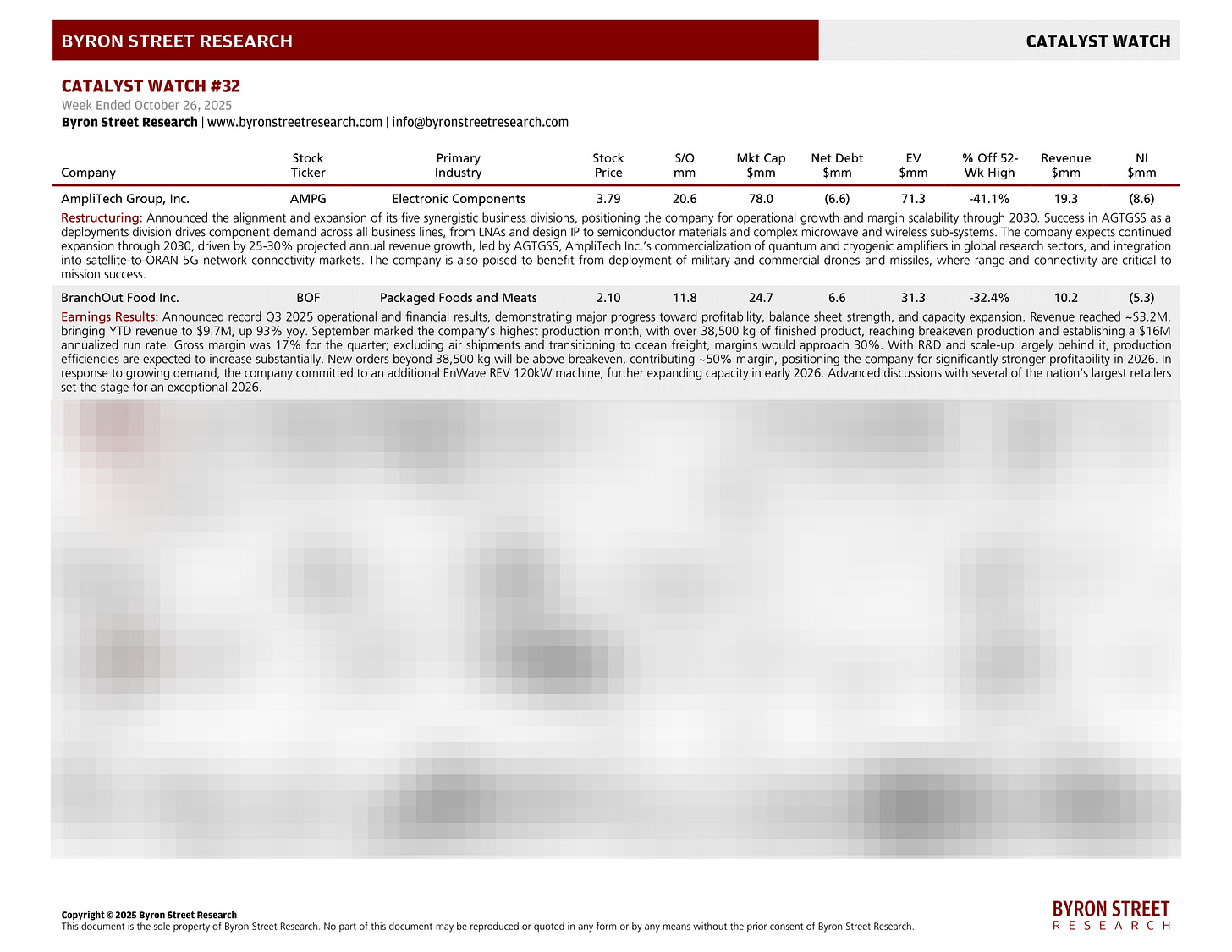

AmpliTech Group, Inc. (AMPG) | Electronic Components | $3.79 | $78.0M

Restructuring: Announced the alignment and expansion of its five synergistic business divisions, positioning the company for operational growth and margin scalability through 2030. Success in AGTGSS as a deployments division drives component demand across all business lines, from LNAs and design IP to semiconductor materials and complex microwave and wireless sub-systems. The company expects continued expansion through 2030, driven by 25-30% projected annual revenue growth, led by AGTGSS, AmpliTech Inc.’s commercialization of quantum and cryogenic amplifiers in global research sectors, and integration into satellite-to-ORAN 5G network connectivity markets. The company is also poised to benefit from deployment of military and commercial drones and missiles, where range and connectivity are critical to mission success.

BranchOut Food Inc. (BOF) | Packaged Foods and Meats | $2.10 | $24.7M

Earnings Results: Announced record Q3 2025 operational and financial results, demonstrating major progress toward profitability, balance sheet strength, and capacity expansion. Revenue reached ~$3.2M, bringing YTD revenue to $9.7M, up 93% yoy. September marked the company’s highest production month, with over 38,500 kg of finished product, reaching breakeven production and establishing a $16M annualized run rate. Gross margin was 17% for the quarter; excluding air shipments and transitioning to ocean freight, margins would approach 30%. With R&D and scale-up largely behind it, production efficiencies are expected to increase substantially. New orders beyond 38,500 kg will be above breakeven, contributing ~50% margin, positioning the company for significantly stronger profitability in 2026. In response to growing demand, the company committed to an additional EnWave REV 120kW machine, further expanding capacity in early 2026. Advanced discussions with several of the nation’s largest retailers set the stage for an exceptional 2026.