Catalyst Watch #40

This Week’s Most Actionable Microcap Press Releases in North America

This Week’s Most Actionable Press Releases

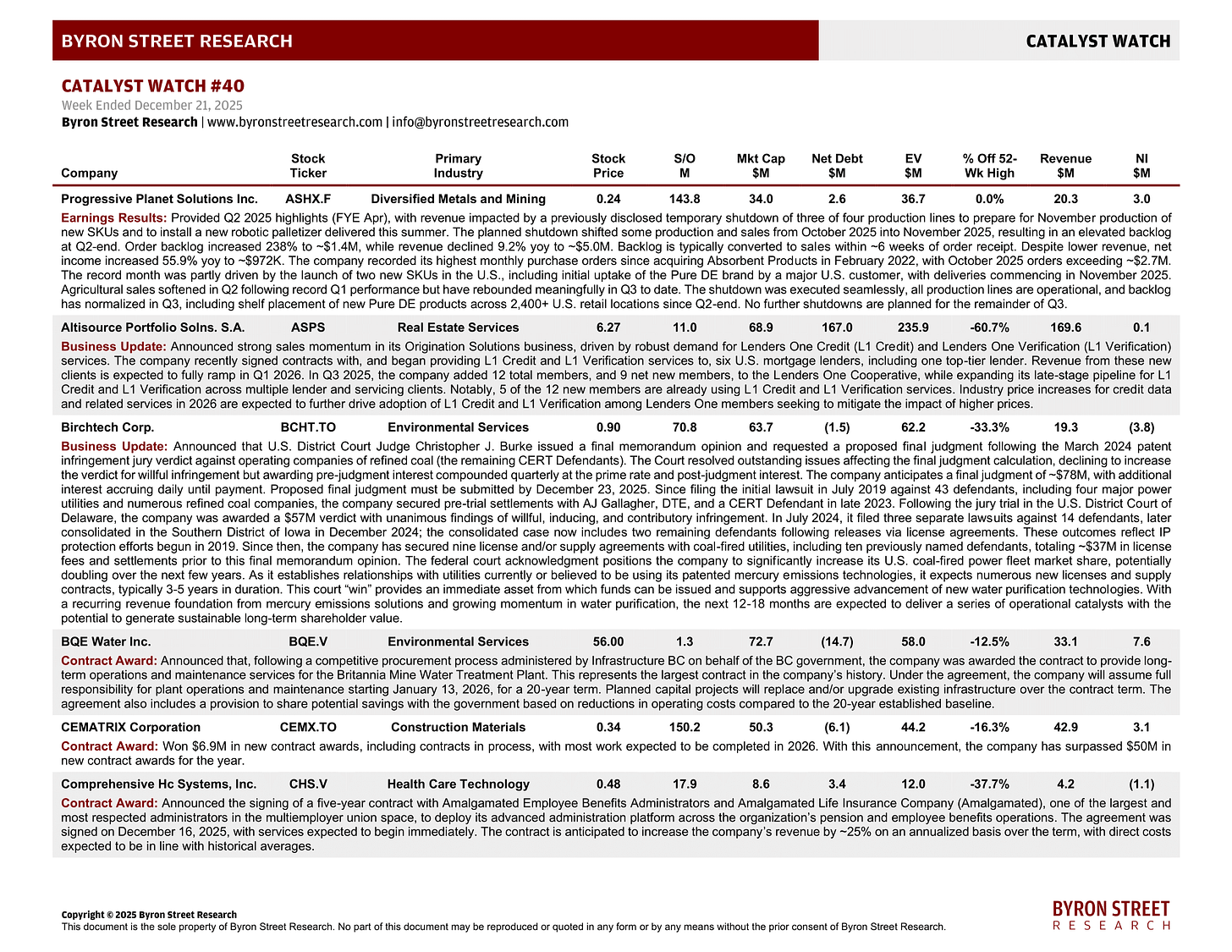

Progressive Planet Solutions Inc. (ASHX.F) | Diversified Metals and Mining | $0.24 | $34.0M

Earnings Results: Provided Q2 2025 highlights (FYE Apr), with revenue impacted by a previously disclosed temporary shutdown of three of four production lines to prepare for November production of new SKUs and to install a new robotic palletizer delivered this summer. The planned shutdown shifted some production and sales from October 2025 into November 2025, resulting in an elevated backlog at Q2-end. Order backlog increased 238% to ~$1.4M, while revenue declined 9.2% yoy to ~$5.0M. Backlog is typically converted to sales within ~6 weeks of order receipt. Despite lower revenue, net income increased 55.9% yoy to ~$972K. The company recorded its highest monthly purchase orders since acquiring Absorbent Products in February 2022, with October 2025 orders exceeding ~$2.7M. The record month was partly driven by the launch of two new SKUs in the U.S., including initial uptake of the Pure DE brand by a major U.S. customer, with deliveries commencing in November 2025. Agricultural sales softened in Q2 following record Q1 performance but have rebounded meaningfully in Q3 to date. The shutdown was executed seamlessly, all production lines are operational, and backlog has normalized in Q3, including shelf placement of new Pure DE products across 2,400+ U.S. retail locations since Q2-end. No further shutdowns are planned for the remainder of Q3.

Altisource Portfolio Solutions S.A. (ASPS) | Real Estate Services | $6.27 | $68.9M

Business Update: Announced strong sales momentum in its Origination Solutions business, driven by robust demand for Lenders One Credit (L1 Credit) and Lenders One Verification (L1 Verification) services. The company recently signed contracts with, and began providing L1 Credit and L1 Verification services to, six U.S. mortgage lenders, including one top-tier lender. Revenue from these new clients is expected to fully ramp in Q1 2026. In Q3 2025, the company added 12 total members, and 9 net new members, to the Lenders One Cooperative, while expanding its late-stage pipeline for L1 Credit and L1 Verification across multiple lender and servicing clients. Notably, 5 of the 12 new members are already using L1 Credit and L1 Verification services. Industry price increases for credit data and related services in 2026 are expected to further drive adoption of L1 Credit and L1 Verification among Lenders One members seeking to mitigate the impact of higher prices.

Birchtech Corp. (BCHT.TO) | Environmental Services | $0.90 | $63.7M

Business Update: Announced that U.S. District Court Judge Christopher J. Burke issued a final memorandum opinion and requested a proposed final judgment following the March 2024 patent infringement jury verdict against operating companies of refined coal (the remaining CERT Defendants). The Court resolved outstanding issues affecting the final judgment calculation, declining to increase the verdict for willful infringement but awarding pre-judgment interest compounded quarterly at the prime rate and post-judgment interest. The company anticipates a final judgment of ~$78M, with additional interest accruing daily until payment. Proposed final judgment must be submitted by December 23, 2025. Since filing the initial lawsuit in July 2019 against 43 defendants, including four major power utilities and numerous refined coal companies, the company secured pre-trial settlements with AJ Gallagher, DTE, and a CERT Defendant in late 2023. Following the jury trial in the U.S. District Court of Delaware, the company was awarded a $57M verdict with unanimous findings of willful, inducing, and contributory infringement. In July 2024, it filed three separate lawsuits against 14 defendants, later consolidated in the Southern District of Iowa in December 2024; the consolidated case now includes two remaining defendants following releases via license agreements. These outcomes reflect IP protection efforts begun in 2019. Since then, the company has secured nine license and/or supply agreements with coal-fired utilities, including ten previously named defendants, totaling ~$37M in license fees and settlements prior to this final memorandum opinion. The federal court acknowledgment positions the company to significantly increase its U.S. coal-fired power fleet market share, potentially doubling over the next few years. As it establishes relationships with utilities currently or believed to be using its patented mercury emissions technologies, it expects numerous new licenses and supply contracts, typically 3-5 years in duration. This court “win” provides an immediate asset from which funds can be issued and supports aggressive advancement of new water purification technologies. With a recurring revenue foundation from mercury emissions solutions and growing momentum in water purification, the next 12-18 months are expected to deliver a series of operational catalysts with the potential to generate sustainable long-term shareholder value.

BQE Water Inc. (BQE.V) | Environmental Services | $56.00 | $72.7M

Contract Award: Announced that, following a competitive procurement process administered by Infrastructure BC on behalf of the BC government, the company was awarded the contract to provide long-term operations and maintenance services for the Britannia Mine Water Treatment Plant. This represents the largest contract in the company’s history. Under the agreement, the company will assume full responsibility for plant operations and maintenance starting January 13, 2026, for a 20-year term. Planned capital projects will replace and/or upgrade existing infrastructure over the contract term. The agreement also includes a provision to share potential savings with the government based on reductions in operating costs compared to the 20-year established baseline.

CEMATRIX Corporation (CEMX.TO) | Construction Materials | $0.34 | $50.3M

Contract Award: Won $6.9M in new contract awards, including contracts in process, with most work expected to be completed in 2026. With this announcement, the company has surpassed $50M in new contract awards for the year.

Comprehensive Healthcare Systems, Inc. (CHS.V) | Health Care Technology | $0.48 | $8.6M

Contract Award: Announced the signing of a five-year contract with Amalgamated Employee Benefits Administrators and Amalgamated Life Insurance Company (Amalgamated), one of the largest and most respected administrators in the multiemployer union space, to deploy its advanced administration platform across the organization’s pension and employee benefits operations. The agreement was signed on December 16, 2025, with services expected to begin immediately. The contract is anticipated to increase the company’s revenue by ~25% on an annualized basis over the term, with direct costs expected to be in line with historical averages.

EnWave Corporation (ENW.V) | Specialty Industrial Machinery | $0.42 | $49.9M

Earnings Results: Reported Q4 2025 financial results (FYE Sep), with revenue rising 71% yoy to C$6.2M. Adjusted EBITDA increased 214% yoy to C$1.4M, driven by machine sales and the production-sales mix relative to the prior year. During the quarter, the company commissioned one large-scale and six small-scale machines, sold a refurbished 120kW unit, and continued fabrication of two large-scale machines on contract.

NetSol Technologies, Inc. (NTWK) | Application Software | $3.13 | $36.9M

Contract Award: Signed a $50M contract extension with a tier-one global auto captive, a long-standing customer and strategic partner since 1996. The total contract value is expected to be recognized over the four-year term, supporting recurring revenue. The extension builds on the company’s earlier multi-country engagement, originally announced in 2015 for over $100M, under which its platform was successfully implemented across 12 markets.

Optex Systems Holdings, Inc (OPXS) | Aerospace and Defense | $14.31 | $98.6M

Earnings Results: Announced FY 2025 financial results (FYE Sep), with total revenues increasing 21.6% yoy to $7.3M. The Optex Richardson segment reported $5.6M in revenue, up 30.8%, driven primarily by a 56% increase in production throughput on the company’s periscope line. The Applied Optics Center segment generated $1.8M in revenue, up 11.1%, driven by higher customer demand for military products, partially offset by lower demand in optical assemblies. Net income applicable to common shareholders was $5.1M, up 36.6% yoy, and adj. EBITDA reached $8.0M, up 40.1% yoy. Revenue growth contributed to strong results across both the income statement and balance sheet, while reducing the company’s net inventory position in line with prior commitments. Significant contract wins and continued investment in equipment and personnel strengthened the company, despite delayed bookings due to postponed ARC III Abrams replenishment contract awards, delayed BNVG Night Vision Goggle program awards, and a U.S. government shutdown delaying the annual congressional appropriations bill. While the company cannot predict the outcomes beyond January 2026, it expects these funding delays may impact revenue in Q2-Q4 2026.

Parks! America, Inc. (PRKA) | Leisure Facilities | $39.72 | $29.9M

Stock Buyback: Authorized a share repurchase program allowing the company to buy up to the lesser of 75,000 shares (9.95% of shares outstanding) or $3M of common stock. Payment for shares repurchased under the program will be funded using the company’s cash on hand.

QuickLogic Corporation (QUIK) | Semiconductors | $5.84 | $99.8M

Contract Award: Announced that the scope of its Prime U.S. government contract for developing Strategic Radiation Hardened (SRH), high-reliability Field Programmable Gate Array (FPGA) technology has been expanded to include GlobalFoundries 12LP fabrication process. With this, the total contract ceiling has increased to $88M over multiple years. The company also completed the design and tape-out of an FPGA test chip, which will be fabricated by GlobalFoundries on the 12LP process.

Shimmick Corporation (SHIM) | Construction and Engineering | $2.60 | $93.1M

Contract Award: Named the preferred bidder on two Los Angeles projects totaling ~$81.5M in new work, spanning water and electrical infrastructure and reflecting growing demand for the company’s integrated civil and electrical delivery capabilities. Berths 49-51 Outer Harbor Cruise Terminal Development is valued at $61.3M, and Palmdale Water Reclamation Plant Influent Pump Station Modifications at $20.2M. Construction on both projects is expected to begin in 2026, following final permitting and preconstruction activities.

SuperCom Ltd. (SPCB) | Security & Protection Services | $8.80 | $41.2M

Contract Award: Announced a new electronic monitoring (EM) service provider contract in North Carolina, marking the company’s first deployment in the state and extending its nationwide expansion to 15 U.S. states since mid-2024. Under the agreement, the company will serve as the primary EM technology partner, transitioning existing GPS tracking infrastructure to its proprietary technology and software platform. The contract follows a recurring revenue model based on active daily units and is separate from the North Carolina Sheriff’s Association procurement vehicle awarded earlier this year. This award, resulting from a competitive evaluation, reflects continued demand for the company’s advanced EM solutions among regional providers seeking to modernize and enhance their programs. The win highlights the company’s momentum in the U.S., with 16 service provider contracts signed since mid-2024, demonstrating its ability to displace incumbents, ramp quickly, and establish a durable presence in new geographies. With record net income of $6M and EBITDA margin exceeding 35% YTD, the company maintains the operational and financial strength to support continued expansion.

Thermal Energy International Inc. (TMG.V) | Pollution & Treatment Controls | $0.12 | $20.5M

Purchase Order: Received a C$3.2M turnkey heat recovery order from a leading multinational frozen food company, following its first heat recovery project with this customer at another site in 2024. The initial project, which was valued at ~C$1M, included project development, design, detailed engineering, and supply of a Flu-Ace, a HeatSponge, and other equipment, but excluded turnkey installation. The new order covers a full turnkey project. With over 40 manufacturing sites worldwide and aggressive greenhouse gas reduction targets, the company sees significant potential with this customer. Two days later, the company announced a ~C$1.5M order from a leading multinational building materials company, following a C$1M turnkey project in July at a different site. The company anticipates additional opportunities with this customer across multiple North American and international facilities.

Zefiro Methane Corp. (ZEFI.NE) | Oil and Gas Exploration and Production | $0.28 | $21.6M

Proxy Fight: Dr. Talal A. Debs, Founder and Director of the company, provided an update to shareholders on recent company developments amid his ongoing activist campaign. He argued that the Board has highlighted recent positive news, much of which was laid by the former leadership team, in an attempt to entrench current management at shareholders’ expense. Actions cited include enhancing executive compensation (including golden parachutes), diluting shareholders via share issuances from debt settlements, and patterns of insider purchases that may overstate shareholder support. Dr. Debs has established a website, www.zefirotruth.com, to keep shareholders informed. Two days later, the company announced that its subsidiary, Plants & Goodwin, Inc. (P&G), successfully completed a $1.5M plug-and-abandonment project as part of a coal-to-natural gas power plant conversion. Throughout 2025, P&G has executed several infrastructure-improvement projects, which differ from its typical plug-and-abandonment work for government and corporate clients. P&G is also set to begin its first project in Louisiana, marking the company’s official expansion into its eighth U.S. state. The project is expected to generate over $5M in revenue and run through March 2026, subject to customary approvals and scheduling.

Download Catalyst Watch

Thanks for reading and spreading the word. If you have any questions or feedback, don’t hesitate to reach out via email at info@byronstreetresearch.com.

Until next time,

Byron Street Research

From that list, I feel OPXS is the best in class. Thanks for sharing.

From that list, I feel OPXS is the best in class