Catalyst Watch #42

This Week’s Most Actionable Microcap Press Releases in North America

Happy New Year!

The year has kicked off with the preparation of the longest and most in-depth write-up I’ve written to date. While model building is on a brief hold as I focus on completing it, the wait will be well worth it.

With only three mildly interesting press releases this week, I’m taking the opportunity to highlight the 10 best-performing flags to date:

BW (May 12): +1,075.9%

BW (Aug 04): +561.5%

CMTL (Apr 14): +300.7%

VERI (Jun 30): +283.2%

SPRU (Aug 11): +251.0%

NURS.V (Apr 14): +243.7%

AEI (Jun 30): +241.0%

GSI.V (May 19): +219.0%

TORO (Apr 21): +175.9%

PPIH (Apr 14): +170.8%

To compile this weekly list, I typically review ~1,500 press releases. The initial shortlist narrows them down to 60-80, which are then examined in more detail. Over time, this process has improved, as reflected in a steady rise in the win ratio, now above 60%.

One of the first things I do with this refined subset is sort it by % off 52-week high and highlight serial diluters and deeply unprofitable companies. This week, half of the list had drawdowns of 90%+ and only one company was profitable. That says it all.

This Week’s Most Actionable Press Releases

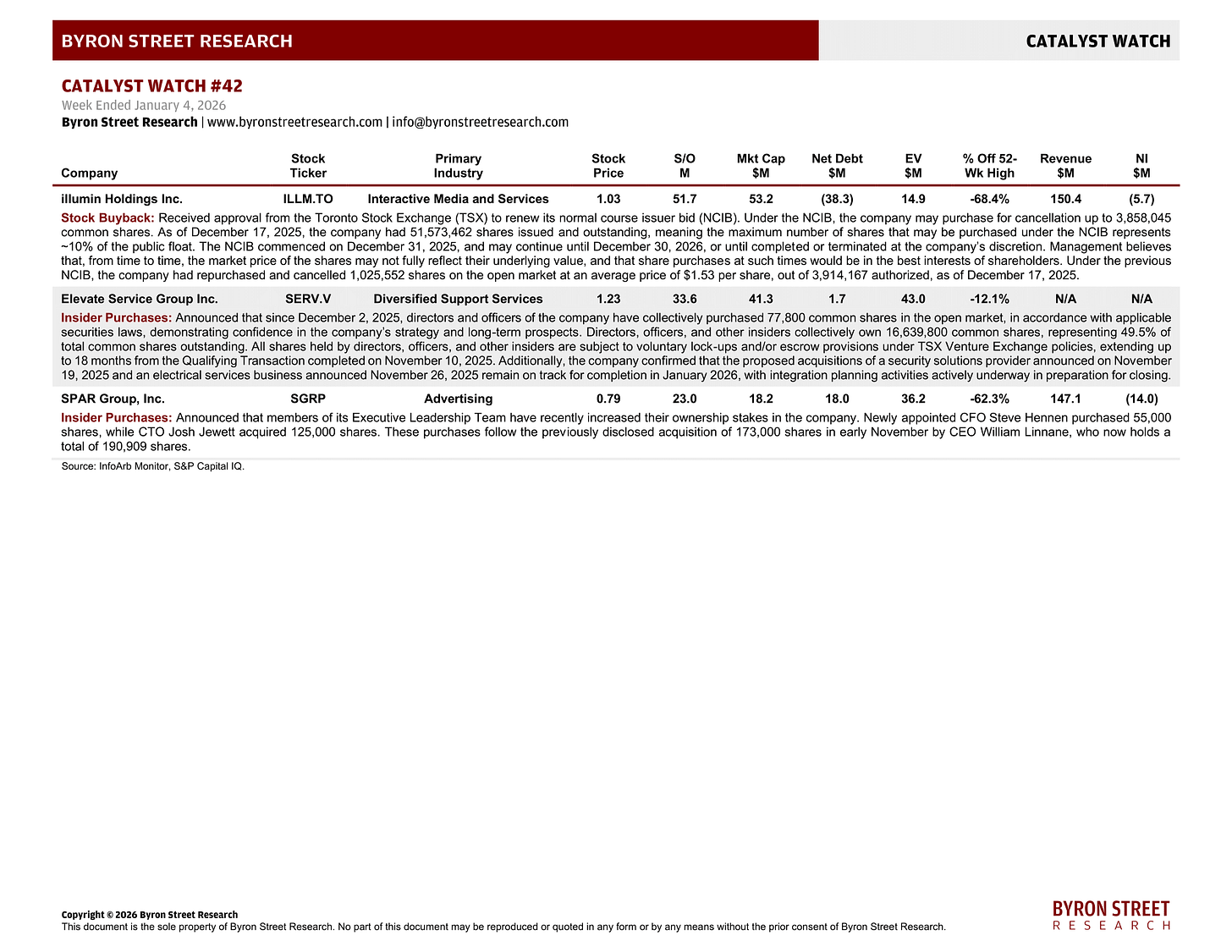

illumin Holdings Inc. (ILLM.TO) | Interactive Media and Services | $1.03 | $53.2M

Stock Buyback: Received approval from the Toronto Stock Exchange (TSX) to renew its normal course issuer bid (NCIB). Under the NCIB, the company may purchase for cancellation up to 3,858,045 common shares. As of December 17, 2025, the company had 51,573,462 shares issued and outstanding, meaning the maximum number of shares that may be purchased under the NCIB represents ~10% of the public float. The NCIB commenced on December 31, 2025, and may continue until December 30, 2026, or until completed or terminated at the company’s discretion. Management believes that, from time to time, the market price of the shares may not fully reflect their underlying value, and that share purchases at such times would be in the best interests of shareholders. Under the previous NCIB, the company had repurchased and cancelled 1,025,552 shares on the open market at an average price of $1.53 per share, out of 3,914,167 authorized, as of December 17, 2025.

Elevate Service Group Inc. (SERV.V) | Diversified Support Services | $1.23 | $41.3M

Insider Purchases: Announced that since December 2, 2025, directors and officers of the company have collectively purchased 77,800 common shares in the open market, in accordance with applicable securities laws, demonstrating confidence in the company’s strategy and long-term prospects. Directors, officers, and other insiders collectively own 16,639,800 common shares, representing 49.5% of total common shares outstanding. All shares held by directors, officers, and other insiders are subject to voluntary lock-ups and/or escrow provisions under TSX Venture Exchange policies, extending up to 18 months from the Qualifying Transaction completed on November 10, 2025. Additionally, the company confirmed that the proposed acquisitions of a security solutions provider announced on November 19, 2025 and an electrical services business announced November 26, 2025 remain on track for completion in January 2026, with integration planning activities actively underway in preparation for closing.

SPAR Group, Inc. (SGRP) | Advertising | $0.79 | $18.2M

Insider Purchases: Announced that members of its Executive Leadership Team have recently increased their ownership stakes in the company. Newly appointed CFO Steve Hennen purchased 55,000 shares, while CTO Josh Jewett acquired 125,000 shares. These purchases follow the previously disclosed acquisition of 173,000 shares in early November by CEO William Linnane, who now holds a total of 190,909 shares.

Download Catalyst Watch

Thanks for reading and spreading the word. If you have any questions or feedback, don’t hesitate to reach out via email at info@byronstreetresearch.com.

Until next time,

Byron Street Research

PPIH could be a sleeping giant. CMTL balance sheet is a mess, but if they can get that straightened out, could get interesting, given satellite exposure theme. It’s one of those risky situations that can double overnight with a shareholder friendly restructuring. Just not sure if they can get it done. Both companies have recently appointed new CEOs.