Catalyst Watch #43

This Week’s Most Actionable Microcap Press Releases in North America

This Week’s Most Actionable Press Releases

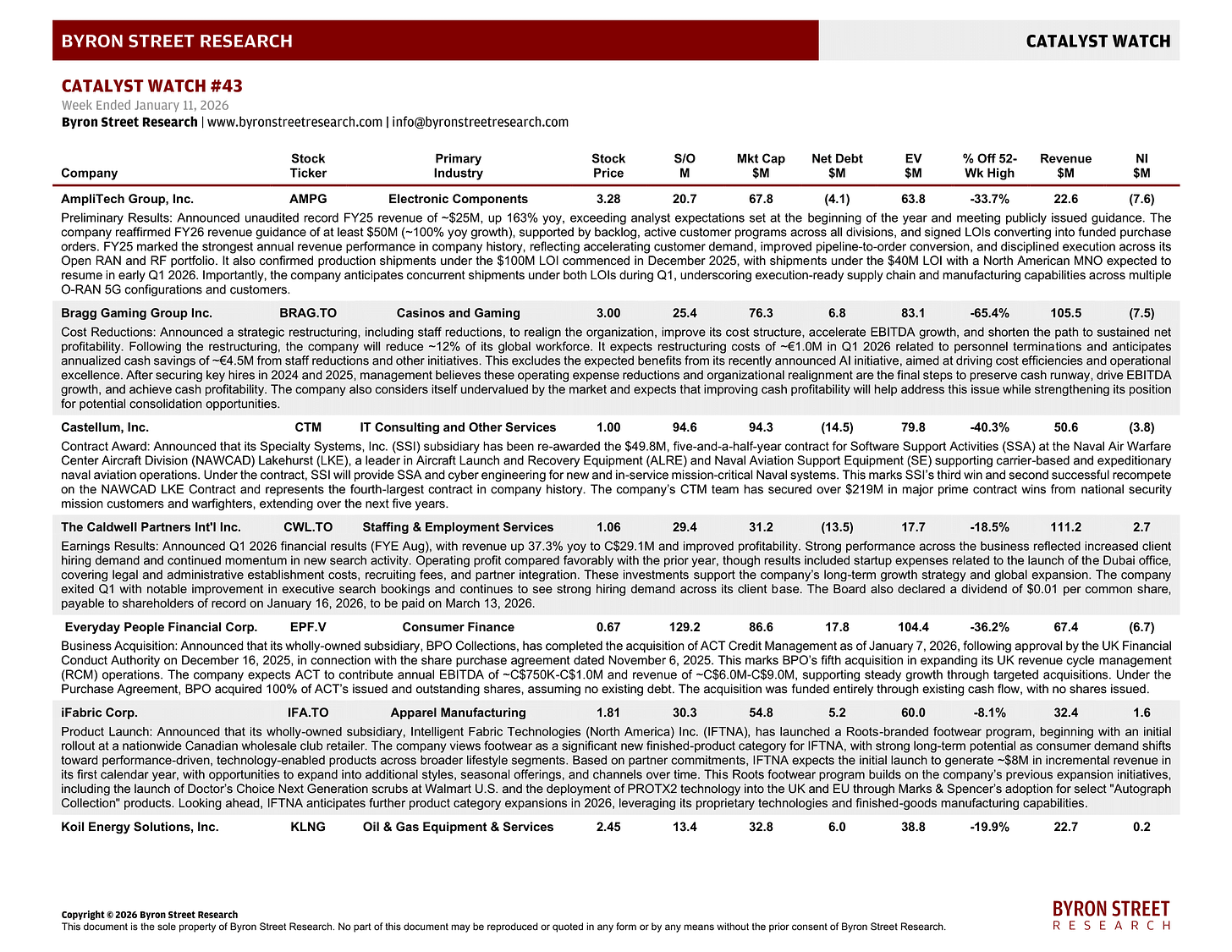

AmpliTech Group, Inc. (AMPG) | Electronic Components | $3.28 | $67.8M

Preliminary Results: Announced unaudited record FY25 revenue of ~$25M, up 163% yoy, exceeding analyst expectations set at the beginning of the year and meeting publicly issued guidance. The company reaffirmed FY26 revenue guidance of at least $50M (~100% yoy growth), supported by backlog, active customer programs across all divisions, and signed LOIs converting into funded purchase orders. FY25 marked the strongest annual revenue performance in company history, reflecting accelerating customer demand, improved pipeline-to-order conversion, and disciplined execution across its Open RAN and RF portfolio. It also confirmed production shipments under the $100M LOI commenced in December 2025, with shipments under the $40M LOI with a North American MNO expected to resume in early Q1 2026. Importantly, the company anticipates concurrent shipments under both LOIs during Q1, underscoring execution-ready supply chain and manufacturing capabilities across multiple O-RAN 5G configurations and customers.

Bragg Gaming Group Inc. (BRAG.TO) | Casinos and Gaming | $3.00 | $76.3M

Cost Reductions: Announced a strategic restructuring, including staff reductions, to realign the organization, improve its cost structure, accelerate EBITDA growth, and shorten the path to sustained net profitability. Following the restructuring, the company will reduce ~12% of its global workforce. It expects restructuring costs of ~€1.0M in Q1 2026 related to personnel terminations and anticipates annualized cash savings of ~€4.5M from staff reductions and other initiatives. This excludes the expected benefits from its recently announced AI initiative, aimed at driving cost efficiencies and operational excellence. After securing key hires in 2024 and 2025, management believes these operating expense reductions and organizational realignment are the final steps to preserve cash runway, drive EBITDA growth, and achieve cash profitability. The company also considers itself undervalued by the market and expects that improving cash profitability will help address this issue while strengthening its position for potential consolidation opportunities.

Castellum, Inc. (CTM) | IT Consulting and Other Services | $1.00 | $94.3M

Contract Award: Announced that its Specialty Systems, Inc. (SSI) subsidiary has been re-awarded the $49.8M, five-and-a-half-year contract for Software Support Activities (SSA) at the Naval Air Warfare Center Aircraft Division (NAWCAD) Lakehurst (LKE), a leader in Aircraft Launch and Recovery Equipment (ALRE) and Naval Aviation Support Equipment (SE) supporting carrier-based and expeditionary naval aviation operations. Under the contract, SSI will provide SSA and cyber engineering for new and in-service mission-critical Naval systems. This marks SSI’s third win and second successful recompete on the NAWCAD LKE Contract and represents the fourth-largest contract in company history. The company’s CTM team has secured over $219M in major prime contract wins from national security mission customers and warfighters, extending over the next five years.

The Caldwell Partners International Inc. (CWL.TO) | Staffing & Employment Services | $1.06 | $31.2M

Earnings Results: Announced Q1 2026 financial results (FYE Aug), with revenue up 37.3% yoy to C$29.1M and improved profitability. Strong performance across the business reflected increased client hiring demand and continued momentum in new search activity. Operating profit compared favorably with the prior year, though results included startup expenses related to the launch of the Dubai office, covering legal and administrative establishment costs, recruiting fees, and partner integration. These investments support the company’s long-term growth strategy and global expansion. The company exited Q1 with notable improvement in executive search bookings and continues to see strong hiring demand across its client base. The Board also declared a dividend of $0.01 per common share, payable to shareholders of record on January 16, 2026, to be paid on March 13, 2026.

Everyday People Financial Corp. (EPF.V) | Consumer Finance | $0.67 | $86.6M

Business Acquisition: Announced that its wholly-owned subsidiary, BPO Collections, has completed the acquisition of ACT Credit Management as of January 7, 2026, following approval by the UK Financial Conduct Authority on December 16, 2025, in connection with the share purchase agreement dated November 6, 2025. This marks BPO’s fifth acquisition in expanding its UK revenue cycle management (RCM) operations. The company expects ACT to contribute annual EBITDA of ~C$750K-C$1.0M and revenue of ~C$6.0M-C$9.0M, supporting steady growth through targeted acquisitions. Under the Purchase Agreement, BPO acquired 100% of ACT’s issued and outstanding shares, assuming no existing debt. The acquisition was funded entirely through existing cash flow, with no shares issued.

iFabric Corp. (IFA.TO) | Apparel Manufacturing | $1.81 | $54.8M

Product Launch: Announced that its wholly-owned subsidiary, Intelligent Fabric Technologies (North America) Inc. (IFTNA), has launched a Roots-branded footwear program, beginning with an initial rollout at a nationwide Canadian wholesale club retailer. The company views footwear as a significant new finished-product category for IFTNA, with strong long-term potential as consumer demand shifts toward performance-driven, technology-enabled products across broader lifestyle segments. Based on partner commitments, IFTNA expects the initial launch to generate ~$8M in incremental revenue in its first calendar year, with opportunities to expand into additional styles, seasonal offerings, and channels over time. This Roots footwear program builds on the company’s previous expansion initiatives, including the launch of Doctor’s Choice Next Generation scrubs at Walmart U.S. and the deployment of PROTX2 technology into the UK and EU through Marks & Spencer’s adoption for select “Autograph Collection” products. Looking ahead, IFTNA anticipates further product category expansions in 2026, leveraging its proprietary technologies and finished-goods manufacturing capabilities.

Koil Energy Solutions, Inc. (KLNG) | Oil & Gas Equipment & Services | $2.45 | $32.8M