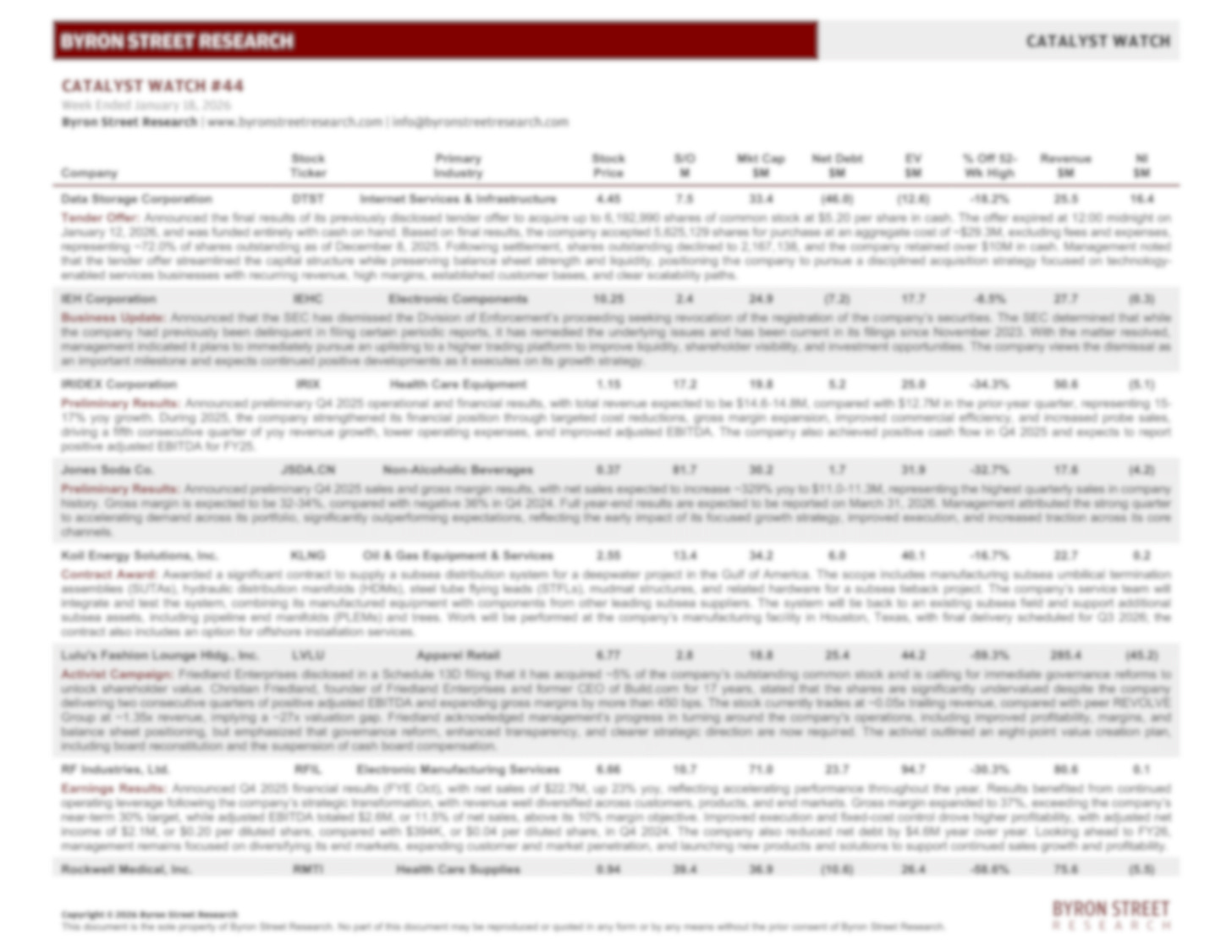

Catalyst Watch #44

This Week’s Most Actionable Microcap Press Releases in North America

This Week’s Most Actionable Press Releases

Data Storage Corporation (DTST) | Internet Services & Infrastructure | $4.45 | $33.4M

Tender Offer: Announced the final results of its previously disclosed tender offer to acquire up to 6,192,990 shares of common stock at $5.20 per share in cash. The offer expired at 12:00 midnight on January 12, 2026, and was funded entirely with cash on hand. Based on final results, the company accepted 5,625,129 shares for purchase at an aggregate cost of ~$29.3M, excluding fees and expenses, representing ~72.0% of shares outstanding as of December 8, 2025. Following settlement, shares outstanding declined to 2,167,138, and the company retained over $10M in cash. Management noted that the tender offer streamlined the capital structure while preserving balance sheet strength and liquidity, positioning the company to pursue a disciplined acquisition strategy focused on technology-enabled services businesses with recurring revenue, high margins, established customer bases, and clear scalability paths.

IEH Corporation (IEHC) | Electronic Components | $10.25 | $24.9M

Business Update: Announced that the SEC has dismissed the Division of Enforcement’s proceeding seeking revocation of the registration of the company’s securities. The SEC determined that while the company had previously been delinquent in filing certain periodic reports, it has remedied the underlying issues and has been current in its filings since November 2023. With the matter resolved, management indicated it plans to immediately pursue an uplisting to a higher trading platform to improve liquidity, shareholder visibility, and investment opportunities. The company views the dismissal as an important milestone and expects continued positive developments as it executes on its growth strategy.

IRIDEX Corporation (IRIX) | Health Care Equipment | $1.15 | $19.8M

Preliminary Results: Announced preliminary Q4 2025 operational and financial results, with total revenue expected to be $14.6-14.8M, compared with $12.7M in the prior-year quarter, representing 15-17% yoy growth. During 2025, the company strengthened its financial position through targeted cost reductions, gross margin expansion, improved commercial efficiency, and increased probe sales, driving a fifth consecutive quarter of yoy revenue growth, lower operating expenses, and improved adjusted EBITDA. The company also achieved positive cash flow in Q4 2025 and expects to report positive adjusted EBITDA for FY25.

Jones Soda Co. (JSDA.CN) | Non-Alcoholic Beverages | $0.37 | $30.2M

Preliminary Results: Announced preliminary Q4 2025 sales and gross margin results, with net sales expected to increase ~329% yoy to $11.0-11.3M, representing the highest quarterly sales in company history. Gross margin is expected to be 32-34%, compared with negative 36% in Q4 2024. Full year-end results are expected to be reported on March 31, 2026. Management attributed the strong quarter to accelerating demand across its portfolio, significantly outperforming expectations, reflecting the early impact of its focused growth strategy, improved execution, and increased traction across its core channels.

Koil Energy Solutions, Inc. (KLNG) | Oil & Gas Equipment & Services | $2.55 | $34.2M

Contract Award: Awarded a significant contract to supply a subsea distribution system for a deepwater project in the Gulf of America. The scope includes manufacturing subsea umbilical termination assemblies (SUTAs), hydraulic distribution manifolds (HDMs), steel tube flying leads (STFLs), mudmat structures, and related hardware for a subsea tieback project. The company’s service team will integrate and test the system, combining its manufactured equipment with components from other leading subsea suppliers. The system will tie back to an existing subsea field and support additional subsea assets, including pipeline end manifolds (PLEMs) and trees. Work will be performed at the company’s manufacturing facility in Houston, Texas, with final delivery scheduled for Q3 2026; the contract also includes an option for offshore installation services.

Lulu’s Fashion Lounge Holdings, Inc. (LVLU) | Apparel Retail | $6.77 | $18.8M

Activist Campaign: Friedland Enterprises disclosed in a Schedule 13D filing that it has acquired ~5% of the company’s outstanding common stock and is calling for immediate governance reforms to unlock shareholder value. Christian Friedland, founder of Friedland Enterprises and former CEO of Build.com for 17 years, stated that the shares are significantly undervalued despite the company delivering two consecutive quarters of positive adjusted EBITDA and expanding gross margins by more than 450 bps. The stock currently trades at ~0.05x trailing revenue, compared with peer REVOLVE Group at ~1.35x revenue, implying a ~27x valuation gap. Friedland acknowledged management’s progress in turning around the company’s operations, including improved profitability, margins, and balance sheet positioning, but emphasized that governance reform, enhanced transparency, and clearer strategic direction are now required. The activist outlined an eight-point value creation plan, including board reconstitution and the suspension of cash board compensation.