Catalyst Watch #45

This Week’s Most Actionable Microcap Press Releases in North America

This Week’s Most Actionable Press Releases

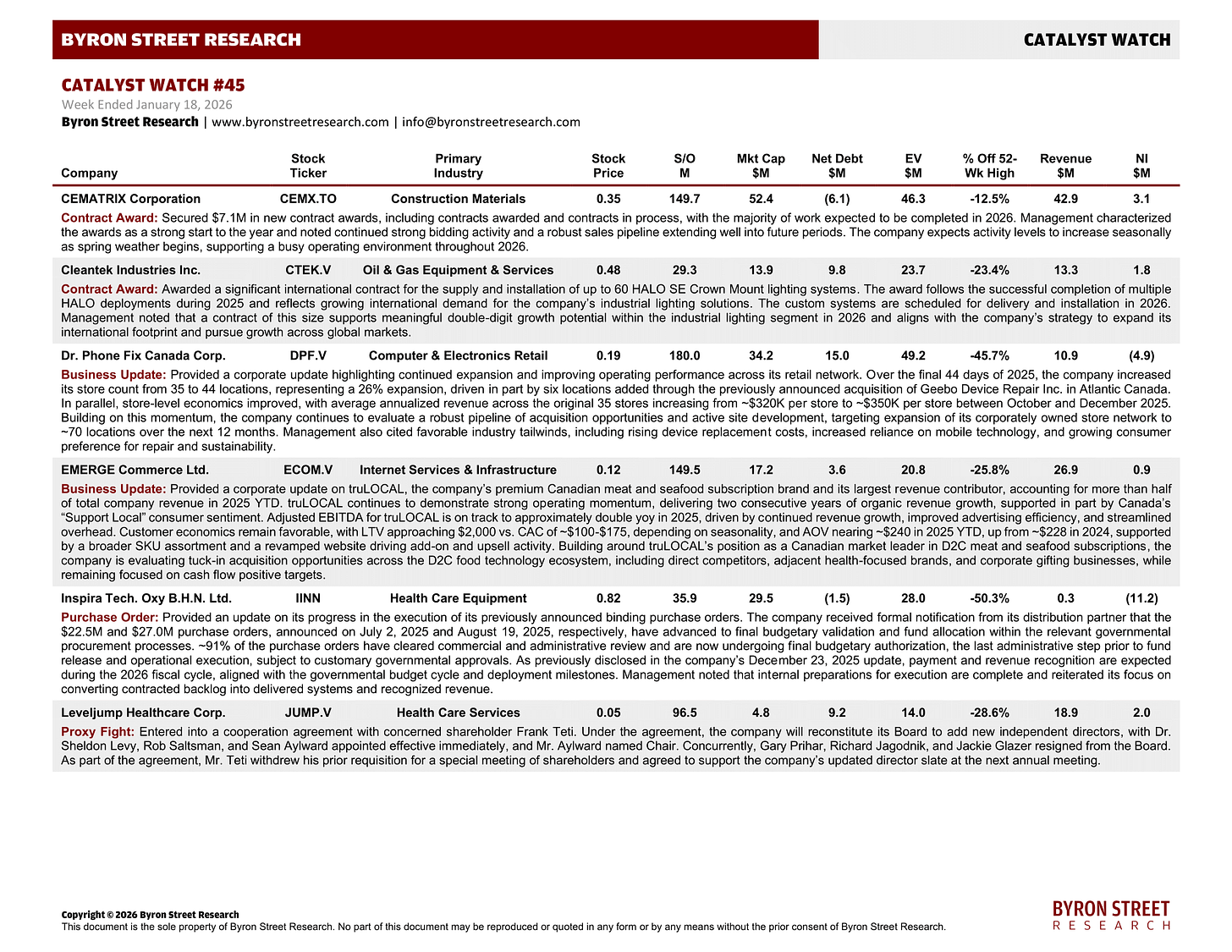

CEMATRIX Corporation (CEMX.TO) | Construction Materials | $0.35 | $52.4M

Contract Award: Secured $7.1M in new contract awards, including contracts awarded and contracts in process, with the majority of work expected to be completed in 2026. Management characterized the awards as a strong start to the year and noted continued strong bidding activity and a robust sales pipeline extending well into future periods. The company expects activity levels to increase seasonally as spring weather begins, supporting a busy operating environment throughout 2026.

Cleantek Industries Inc. (CTEK.V) | Oil & Gas Equipment & Services | $0.48 | $13.9M

Contract Award: Awarded a significant international contract for the supply and installation of up to 60 HALO SE Crown Mount lighting systems. The award follows the successful completion of multiple HALO deployments during 2025 and reflects growing international demand for the company’s industrial lighting solutions. The custom systems are scheduled for delivery and installation in 2026. Management noted that a contract of this size supports meaningful double-digit growth potential within the industrial lighting segment in 2026 and aligns with the company’s strategy to expand its international footprint and pursue growth across global markets.

Dr. Phone Fix Canada Corporation (DPF.V) | Computer & Electronics Retail | $0.19 | $34.2M

Business Update: Provided a corporate update highlighting continued expansion and improving operating performance across its retail network. Over the final 44 days of 2025, the company increased its store count from 35 to 44 locations, representing a 26% expansion, driven in part by six locations added through the previously announced acquisition of Geebo Device Repair Inc. in Atlantic Canada. In parallel, store-level economics improved, with average annualized revenue across the original 35 stores increasing from ~$320K per store to ~$350K per store between October and December 2025. Building on this momentum, the company continues to evaluate a robust pipeline of acquisition opportunities and active site development, targeting expansion of its corporately owned store network to ~70 locations over the next 12 months. Management also cited favorable industry tailwinds, including rising device replacement costs, increased reliance on mobile technology, and growing consumer preference for repair and sustainability.

EMERGE Commerce Ltd. (ECOM.V) | Internet Services & Infrastructure | $0.12 | $17.2M

Business Update: Provided a corporate update on truLOCAL, the company’s premium Canadian meat and seafood subscription brand and its largest revenue contributor, accounting for more than half of total company revenue in 2025 YTD. truLOCAL continues to demonstrate strong operating momentum, delivering two consecutive years of organic revenue growth, supported in part by Canada’s “Support Local” consumer sentiment. Adjusted EBITDA for truLOCAL is on track to approximately double yoy in 2025, driven by continued revenue growth, improved advertising efficiency, and streamlined overhead. Customer economics remain favorable, with LTV approaching $2,000 vs. CAC of ~$100-$175, depending on seasonality, and AOV nearing ~$240 in 2025 YTD, up from ~$228 in 2024, supported by a broader SKU assortment and a revamped website driving add-on and upsell activity. Building around truLOCAL’s position as a Canadian market leader in D2C meat and seafood subscriptions, the company is evaluating tuck-in acquisition opportunities across the D2C food technology ecosystem, including direct competitors, adjacent health-focused brands, and corporate gifting businesses, while remaining focused on cash flow positive targets.

Inspira Technologies Oxy B.H.N. Ltd. (IINN) | Health Care Equipment | $0.82 | $29.5M

Purchase Order: Provided an update on its progress in the execution of its previously announced binding purchase orders. The company received formal notification from its distribution partner that the $22.5M and $27.0M purchase orders, announced on July 2, 2025 and August 19, 2025, respectively, have advanced to final budgetary validation and fund allocation within the relevant governmental procurement processes. ~91% of the purchase orders have cleared commercial and administrative review and are now undergoing final budgetary authorization, the last administrative step prior to fund release and operational execution, subject to customary governmental approvals. As previously disclosed in the company’s December 23, 2025 update, payment and revenue recognition are expected during the 2026 fiscal cycle, aligned with the governmental budget cycle and deployment milestones. Management noted that internal preparations for execution are complete and reiterated its focus on converting contracted backlog into delivered systems and recognized revenue.

Leveljump Healthcare Corp. (JUMP.V) | Health Care Services | $0.05 | $4.8M

Proxy Fight: Entered into a cooperation agreement with concerned shareholder Frank Teti. Under the agreement, the company will reconstitute its Board to add new independent directors, with Dr. Sheldon Levy, Rob Saltsman, and Sean Aylward appointed effective immediately, and Mr. Aylward named Chair. Concurrently, Gary Prihar, Richard Jagodnik, and Jackie Glazer resigned from the Board. As part of the agreement, Mr. Teti withdrew his prior requisition for a special meeting of shareholders and agreed to support the company’s updated director slate at the next annual meeting.

MarketWise, Inc. (MKTW) | Financial Exchanges & Data | $16.05 | $38.8M

Preliminary Results: Reported preliminary Q4 2025 financial and operational results, consistent with prior practice, ahead of issuing full FY25 results in March 2026. Q4 billings (net sales) were ~$79M, representing a sequential increase of more than 23% and yoy growth of 42%, bringing FY25 billings to ~$271M and exceeding prior guidance of $250M. Following several quarters of declining billings, the company reached an inflection point in Q4 2024 with a return to sequential growth, which has continued steadily through Q4 2025, excluding a temporary spike in Q1 2025. Cash flow from operations totaled ~$24M in Q4 and ~$45M for FY25, exceeding prior guidance of $30M and representing an improvement of ~$65M yoy. Over the past twelve months, cumulative dividends paid to Class A shareholders equated to a cash dividend yield of ~13% based on the December 31, 2025 share price. As of December 31, 2025, the company had 374K paid subscribers, relatively flat compared to September 30, 2025. Since mid-2024, the company has pivoted toward higher-priced offerings, resulting in improved subscriber quality and lifetime value despite a decline in absolute subscriber count over the past two years. Customer mix continues to improve, with 65% of customers having lifetime spend exceeding $500, while churn remains concentrated in lower-value tiers. This favorable mix shift has supported recent sales growth and margin expansion. Tax distribution payments were elevated in FY25 due to the timing of taxable income generated in prior years; for FY26, tax distributions are expected to decline to ~$35M, or ~$15M lower than FY25, with higher payments anticipated in H1 and lower payments in H2. As a result, management expects cash balances to decline in H1 2026 before increasing in H2. Separately, on October 29, 2025, the company disclosed receipt of a proposal from Monument & Cathedral Holdings, LLC (and affiliates) to acquire all outstanding equity interests not already owned by M&C for $17.25 per share in cash, contingent on termination of the company’s tax receivable agreement. A special committee of the Board is evaluating the proposal with the assistance of legal and financial advisors.

Orion Energy Systems, Inc. (OESX) | Electrical Parts & Equipment | $16.67 | $58.9M

Contract Award: Awarded a new large-scale LED exterior lighting project with a leading international retail chain, expected to generate ~$14-15M in revenue. The project is scheduled to begin in fiscal Q4 2026, with the majority of work expected to be completed by the end of July 2026, and represents a significant incremental engagement with this enterprise customer. The award follows the company’s October 21, 2025 announcement of a three-year renewal of a major LED lighting maintenance contract for the same customer, valued at ~$42-45M, covering maintenance of LED lighting systems across more than 2,000 stores, in addition to ongoing new-store work. Separately, the company increased its FY26 revenue outlook to $84-86M, up from its prior outlook of ~$84M, and expects preliminary unaudited Q4 2026 revenue of ~$21M, with anticipated positive net income and positive adjusted EBITDA, marking the fifth consecutive quarter of adjusted EBITDA profitability. Management also expects to achieve positive adjusted EBITDA for the full FY26 and currently forecasts positive adjusted EBITDA on revenue of $95-97M in FY27, which begins April 1, 2026. The company attributed its improved growth and profitability outlook to increased enterprise customer orders, the benefits of recent cost-structure improvements, and enhanced competitive positioning.

Off The Hook YS Inc. (OTH) | Automotive Retail | $2.65 | $62.9M

Business Update: Expanded inventory financing capacity to $60M, more than doubling its floorplan facility from $25M prior to its IPO. The expanded facility enhances the company’s ability to acquire and carry higher levels of used boat inventory to meet accelerating customer demand and support its growth strategy in 2026. Increased inventory availability is expected to support robust yoy growth, with management forecasting 2026 revenue of $140-145M. With greater floorplan capacity, the company expects to broaden its inventory selection across key geographies and boat categories, supporting improved customer matching, higher conversion rates, faster inventory turnover, and increased sales velocity.

PodcastOne, Inc. (PODC) | Movies & Entertainment | $2.78 | $74.8M

Preliminary Results: Announced anticipated record Q3 2026 financial results (FYE Mar), along with key operating highlights and updated FY26 guidance. Q3 revenue is expected to be $15.3-15.5M+, with adjusted EBITDA of $1.8-2.3M+, representing more than 350% yoy growth. The company raised FY26 guidance to $58-60M in revenue and $5-6M in adjusted EBITDA. Management attributed the expected performance to continued expansion of its podcast network, strong advertiser demand, and the success of strategic partnerships. The company also highlighted the addition of Dr. Phil, a strengthened balance sheet, and full repayment of Capchase debt as factors positioning it well for the next phase of growth, including potential strategic M&A.

SuperCom Ltd. (SPCB) | Security & Protection Services | $8.20 | $38.4M

Contract Award: Announced its third electronic monitoring (EM) contract in North Carolina, one month after its initial PureOne deployment in the state. The award follows the December 2025 PureOne rollout with a local service provider and the statewide procurement vehicle awarded earlier in 2025 by the North Carolina Sheriff’s Association, reinforcing continued adoption by providers launching new programs or modernizing existing community supervision operations. The provider is introducing EM technology for the first time and selected the company at program launch, highlighting its ability to support rapid implementations across varying levels of EM experience. Deployment is expected to begin immediately, with the contract structured as a recurring revenue model based on active daily units. Management noted that North Carolina exemplifies its U.S. expansion strategy, where initial entry and statewide procurement wins are followed by county-level expansions that broaden adoption over time.

Stran & Company, Inc. (SWAG) | Advertising | $2.00 | $36.6M

Contract Award: Signed a three-year, multi-million-dollar contract extension with a premier nonprofit running organization, one of the most recognized community-based running groups globally. Under the agreement, the company will continue to serve as a key merchandise partner, supplying branded apparel and merchandise for the organization’s flagship annual marathon and other marquee running events. The extension is expected to generate predictable, recurring revenue and aligns with the company’s strategy to deepen long-term partnerships with premier organizations and high-profile events, providing improved revenue visibility and strengthening its position within the sports and experiential marketing vertical.

Download This Week’s Catalyst Watch

Thanks for reading and spreading the word. If you have any questions or feedback, don’t hesitate to reach out via email at info@byronstreetresearch.com.

Until next time,

Byron Street Research