Intellicheck, Inc. (IDN)

Cracking the (Bar)Code of Fraud

IDN is a ~$50mm company securing contracts with some of the world’s largest corporations, all while being surrounded by a moat wider than the Grand Canyon. With 90%+ margins and a clear path for reaccelerated growth, it’s hard to see how this stock won’t exceed expectations. But let me first introduce you to the idea.

Data breaches are surging. The recent United Healthcare breach exposed data on roughly a third of all Americans. For ~$20, this stolen data is available on the dark web, and for just ~$40 more, you can get a visually undetectable by law enforcement fake ID. But who cares about manual checks anymore, right? Surely computers can catch it all.

Wrong. Every competitor relies on OCR templating, a method with detection rates ranging from 65% to 75%. Claims of higher accuracy? Don’t trust them. In contrast, IDN has a ~99.9% detection rate, thanks to its longstanding relationships with the AAMVA and DMVs.

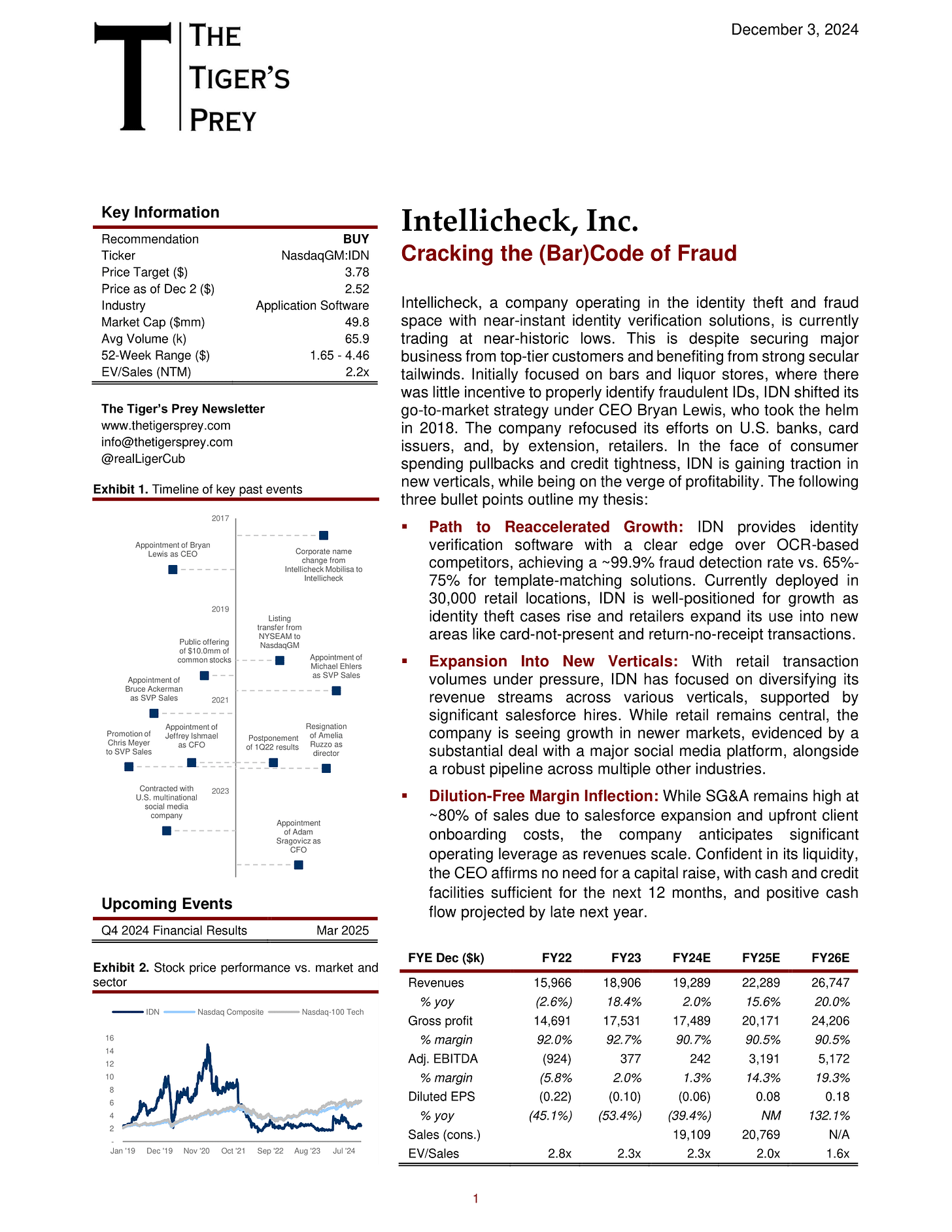

So, why does this opportunity exist? Growth has decelerated, but I've examined the causes and uncovered a relationship that dictates an imminent reversal. Importantly, there is a hard catalyst too. During onboarding, strict NDAs prevent IDN from disclosing the identity of new clients, but sometimes the company gives some clues.

Take 2020, for example. IDN secured a contract with a multinational financial services company that "provides innovative payment, travel, and expense management solutions for individuals and businesses of all sizes." A quick copy-paste into Google revealed it was American Express. By April 2021, the stock had quadrupled.

Now, the multinational company IDN signed a contract with is not a card issuer, but "one of the largest social media platforms in the world." The setup looks familiar, but will history repeat?

Scroll down to download the full report and model.