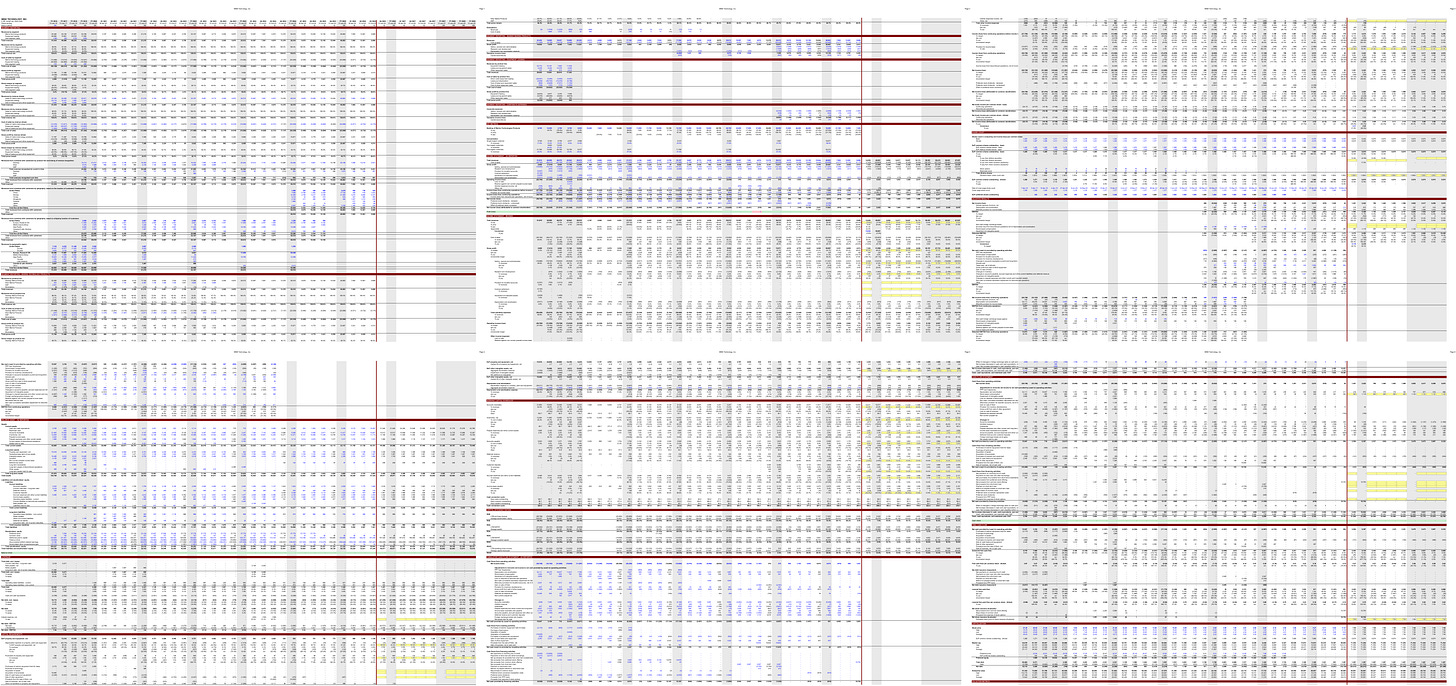

MIND Technology, Inc. (MIND)

New Watchlist Model Updated for Q3 2026 | New Build

MIND Technology, Inc. (MIND)

Formerly known as Mitcham Industries, MIND is a global provider of maritime technology products for exploration, survey, and defense applications. After divesting its Klein unit in 2023 and exiting from its legacy seismic land leasing operations in 2020, the company transformed into a pure-play marine technology provider with Seamap as its sole reportable segment. At the same time, it materially improved its balance sheet by eliminating its preferred stock overhang and repaying high-cost debt.

However, despite a consistent multi-year bottom-line improvement, ultimately turning profitable after more than a decade of deep losses through cost structure optimization and production efficiencies, order timing and customer delivery schedules continue to produce inherently variable quarterly results. In the past quarter, this cyclical pattern again led to a sales dip, while the ~$11M opportunistic draw from its ATM program further irritated an already skeptical shareholder base.

That said, high-margin aftermarket services, including spare parts, repairs, training, and other support activities, now account for an increasing share of revenue, providing a more stable and recurring revenue stream as the installed base of seismic equipment grows. Additionally, the recent expansion of its Huntsville, TX facility has further increased its manufacturing and repair capacity, allowing the company to efficiently take on significantly larger manufacturing and product repair projects.

Despite backlog fluctuations and a temporary lull in order activity as many customers take a wait-and-see approach amid geopolitical and economic uncertainty, the company continues to see steady interest and engagement, supported by a pipeline of pending and potential orders well in excess of reported backlog. The recent receipt of long-pending orders valued in excess of $9.5M is good evidence of this continuing interest, making an uptick in activity all but inevitable.

Zooming out, secular tailwinds in offshore energy, subsea mapping, maritime defense, and the energy transition point to long-duration double-digit growth, with Teledyne’s exit from the source controller market in 2020 leaving MIND as the dominant seismic exploration player and an attractive acquisition target. With ~$36.0M, or $4.00 per share, in working capital, the company warrants close attention as FY27 visibility improves and its margin trajectory continues to inflect.