Monthly Performance Review #4

November 2024

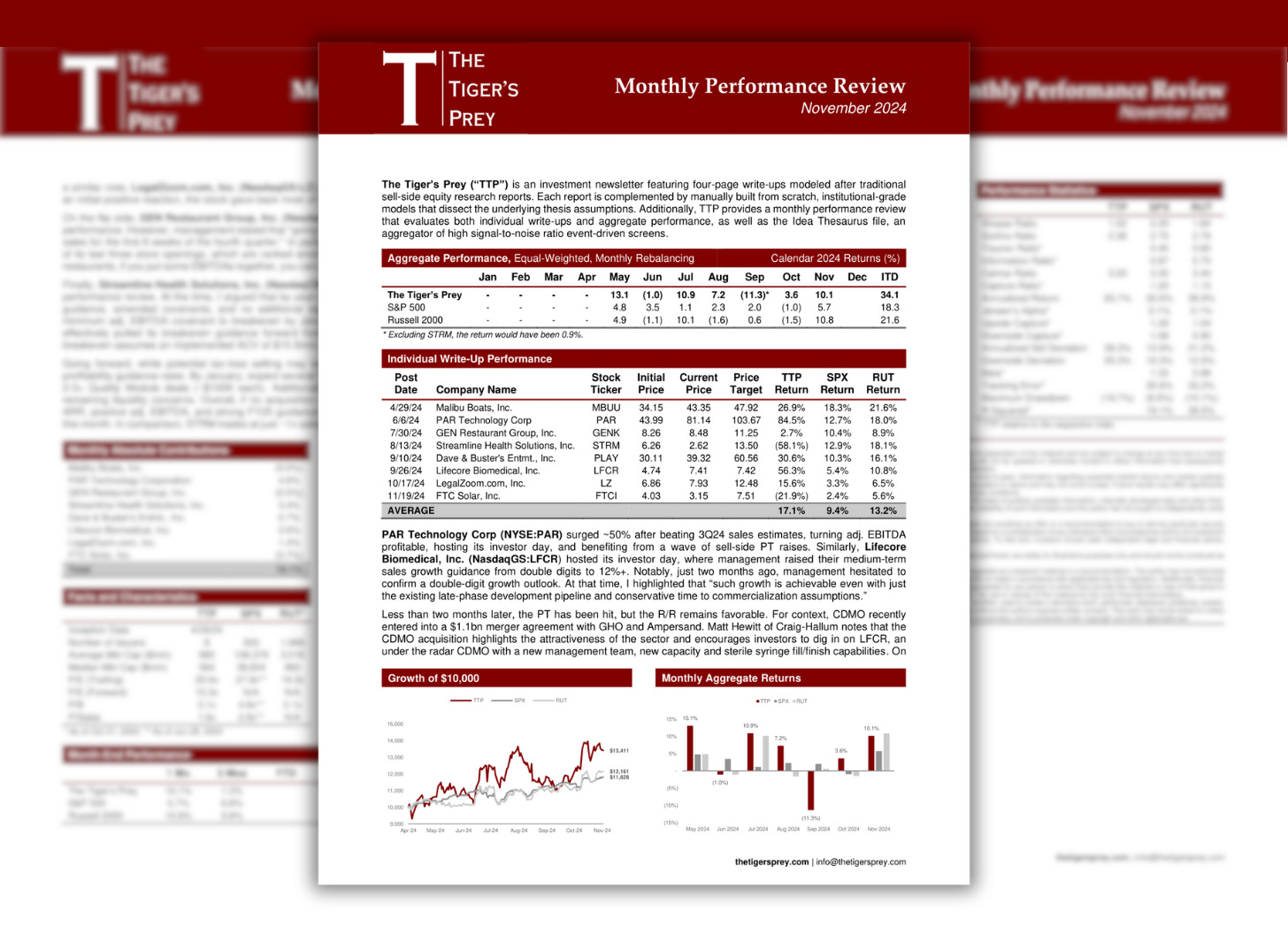

In this performance review, I provide brief commentary on PAR, LFCR, LZ, GENK, and STRM. After month-end, I also profiled IDN, a company I would have overweighted if the aggregate portfolio I’m disclosing hadn’t been equal-weighted.

Equal weights ensure full transparency, allowing you to verify the figures presented on your own. Despite a material negative contribution from STRM, that portfolio has outperformed both the S&P 500 and the Russell 2000.

Regarding IDN, here’s a bit more color:

In 2019, the company signed a 60-day pilot contract with a major bank for a single use case in their call centers. Within 30 days, the bank was so impressed that they transitioned to a full rollout across all call centers, which are staffed with over 4,500 salespeople.

This rapid deployment would’ve been impossible for peers like Acuant, which require lengthy implementation timelines and costly hardware. IDN’s hardware-agnostic solutions made it seamless.

In fact, with this very contract, IDN displaced Acuant, whose software the bank had been using up until then. For context, Acuant was acquired in 2019 by GBG at a whopping 12.7x sales multiple. Compare that to IDN’s current 2-3x, and believe me, it’s just one sign of how wildly inefficient the market still is.

Scroll down to download the full performance review and its accompanying evaluation spreadsheet.