Monthly Performance Review #7

February 2025

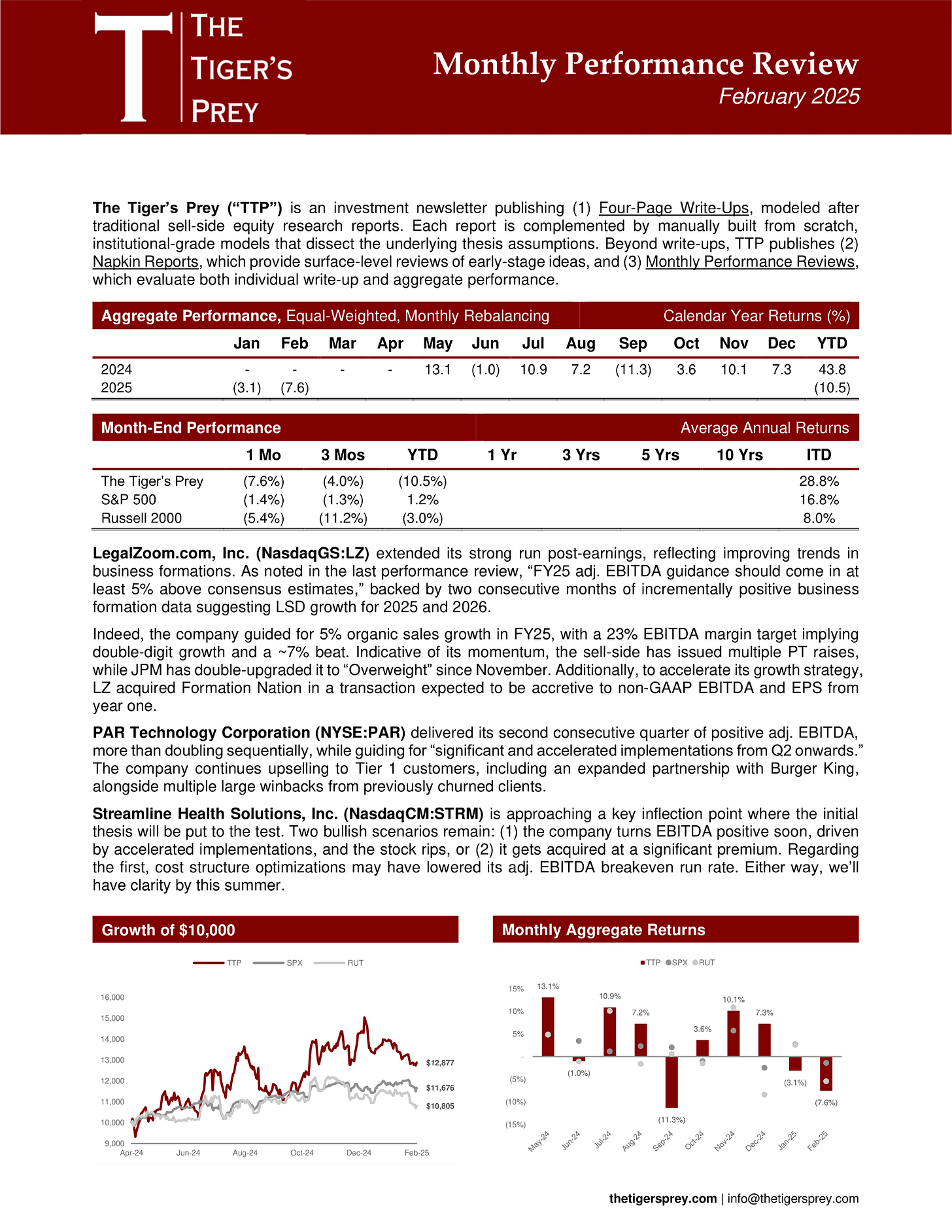

Indiscriminate selling continued into February, despite a generally positive news flow for companies under coverage. To maintain transparency, I’ve not allowed for position sizing, but this doesn’t apply to you. I encourage you to revisit past write-ups and consider taking advantage of opportunities created by this selloff.

The new company coming next week has also been caught in indiscriminate selling, despite no changes to its underlying fundamentals. In fact, unless recent price action is signaling an undisclosed adverse development, its soon-to-be-released results and/or commentary should confirm the ongoing ramp of several recent major wins.

Notably, the company has yet to appear in screens due to several factors. First, its revenue appears flat, though acquisitions have distorted its growth profile. Second, while its reported EBITDA margins are in the single digits, they translate to ~50% on a true net basis. Lastly, its seemingly high debt balance has recently been refinanced.

Scroll down to download the full performance review and its accompanying evaluation spreadsheet.