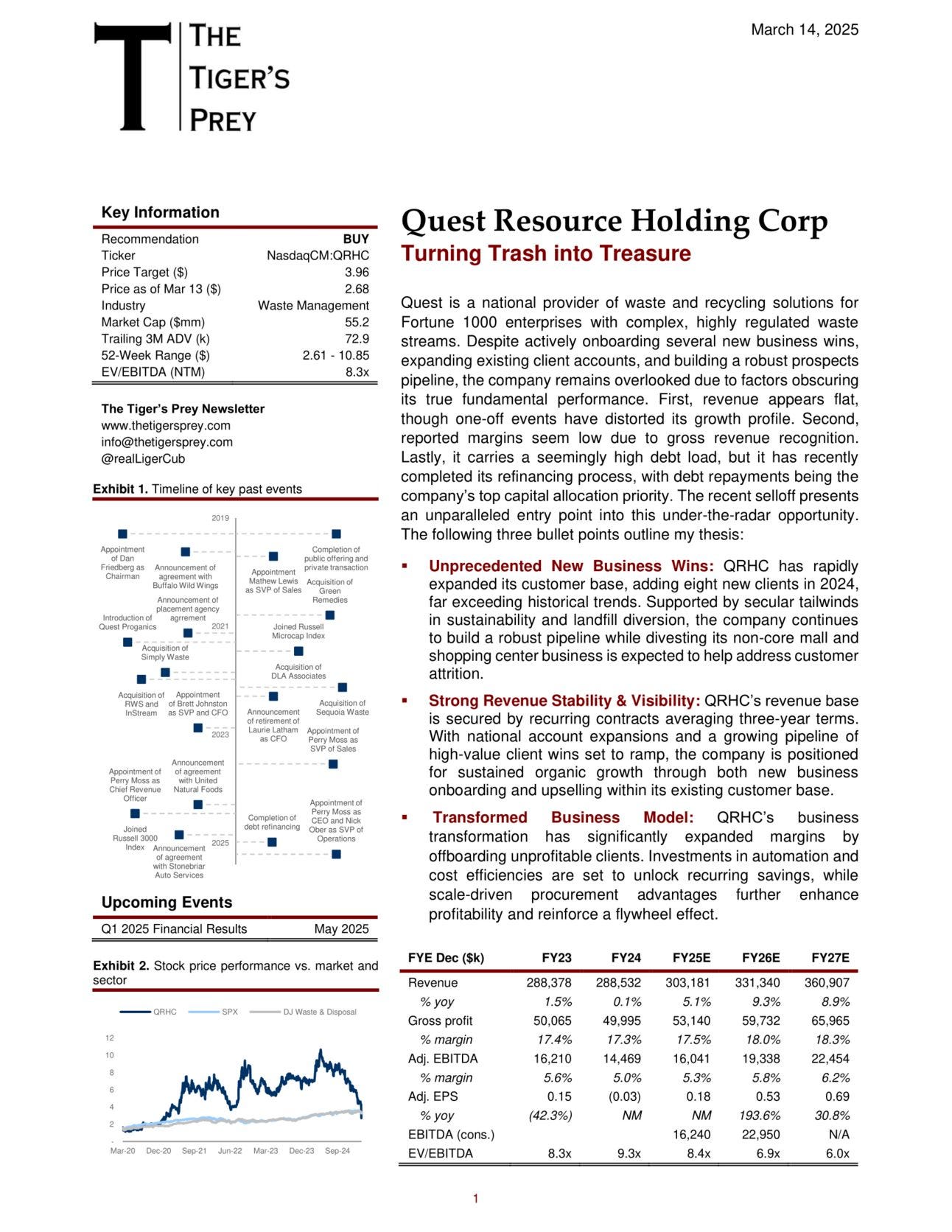

Quest Resource Holding Corp (QRHC)

Turning Trash into Treasure

The selloff leading up to earnings raised suspicions, which were confirmed by the results published on Wednesday. Initially expecting them on Monday or Tuesday, I postponed the write-up by a day to allow the market to react to what had been suspected. Last week, I wrote:

In fact, unless recent price action is signaling an undisclosed adverse development, its soon-to-be-released results and/or commentary should confirm the ongoing ramp of several recent major wins.

As you go through the write-up, it's important to view gross profit as revenue on a net basis. This distinction matters for several reasons. For example, while higher commodity prices inherently drive higher revenue, they have no impact on gross profit.

In detail, waste holds salvage value that can be recovered and recycled into new products. Revenue from the sale of waste commodities is passed through to customers, while QRHC charges a service fee that remains fixed, regardless of commodity price fluctuations.

With that said, I couldn’t imagine a better entry point for this under-the-radar opportunity.

Scroll down to download the full report and model.