Travelzoo (TZOO)

Temporary Margin Drag, Long-Term Subscription Lift

Introducing the New Write-Up Structure

A write-up is the synthesis of all your research into a concise investment note. It’s the finite description of your extensive research that highlights the most important elements of your thesis, including the potential upside if correct, the valuation framework behind it, and the downside risk if it fails to play out.

At Byron Street, write-ups are now structured as one-pagers that mirror the format of sell-side equity research reports, isolating the critical components of each differentiated investment idea. The goal of stock pitching is to communicate an actionable idea effectively and concisely, not to deliver lengthy book reports.

Ideas will fall into one of five categories: compounders, turnarounds, inflections, asset plays, or special situations. Coverage is initiated with a Buy rating and is maintained through earnings previews, reviews, and flash notes carrying Add, Hold, or Trim ratings, before being terminated with an Exit rating.

Each report includes a detailed financial model, built manually from scratch, which is first used to provide a deep understanding of the business and its current state economics. It then serves as the backbone for forecasting key drivers, forming a differentiated view, and deriving accurate price targets.

P.S. While many research houses influenced the one-pager’s structure and format, Raymond James had the greatest impact.

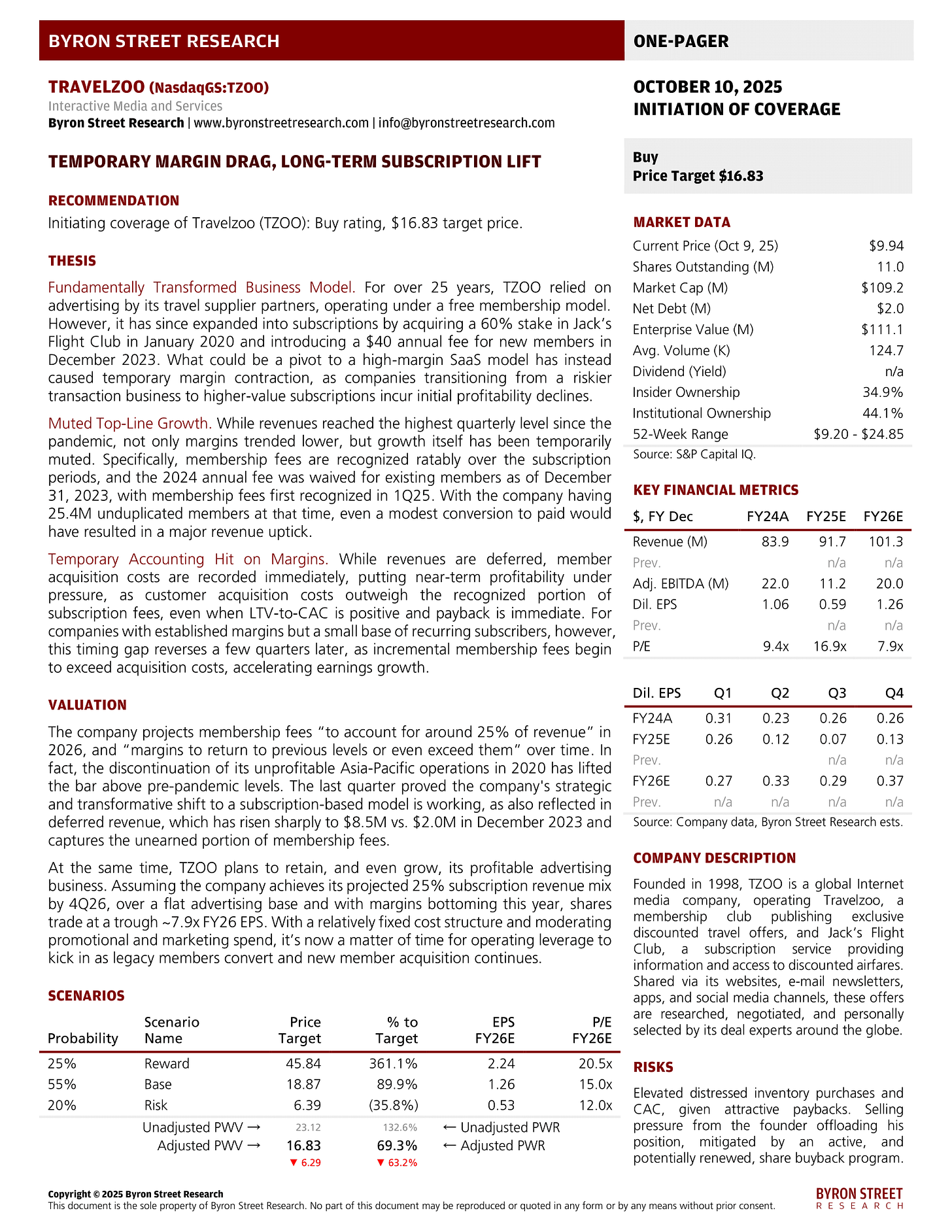

Initiating coverage of Travelzoo (TZOO): Buy rating, $16.83 target price.

In March, I passed on TZOO due to “minimal visibility around the long-term adoption of its premium subscription model, coupled with persistent insider selling.” Since then, not only has visibility improved, but the stock has also been beaten down just ahead of top-line acceleration and significant operating leverage, with buybacks offsetting selling pressure.

As in my previous write-up, accounting rules are largely responsible for the recent sell-off. Unlike last time, however, TZOO will inflect across the board. In fact, the same accounting rules that distort the picture now remove much of the uncertainty surrounding its transformative business model shift.

What should have been an upward revision cycle has instead gone the other way, though inflection is only a matter of time. The new subscription model is working, and conversion is real. But just as transitioning companies must be willing to incur initial, material declines in profitability, the same applies to investors.

In short, when a stock is beaten down after its first discovery cycle and rediscovery is underway, patience is needed. TZOO is definitely one of those cases.

P.S. Adjustments to price targets are inspired by Alpha Theory, with position sizing tied to probability-weighted returns and conviction. The latter, however, cannot be borrowed.

Scroll down to download the report and model.

Download the Report and Model

Thanks for reading and for spreading the word. If you have any questions or feedback, don’t hesitate to reach out via email at info@byronstreetresearch.com.

Until next time,

Byron Street Research

What's the churn on the membership?